Amazon accounting is renowned for being a relatively complex, very time-consuming, and highly stressful process. This is why many people resort to accountants and bookkeepers to ensure their tax obligations are fulfilled. However, there’s no reason why you should avoid tackling your financial health yourself! All you need to do is make sure you are actually accounting for things accurately so you can instead focus on having a good profit margin.

This article will cover everything you need to know about Amazon accounting, including the three most common mistakes Amazon sellers make when doing their taxes and how to fix them. So, let’s get started.

What Makes Amazon Business Accounting so Challenging?

If you run an Amazon business, the one thing you’re probably not looking forward to doing each month is your bookkeeping. In fact, many business owners choose instead to use an accountant, so they don’t have to deal with it at all.

Every industry has its caveats, and an eCommerce business definitely comes with its own unique set of challenges. For one, most Amazon sellers have to handle inventory across multiple marketplaces, so while attempting to keep track of your products, you can quickly end up having inaccurate balance sheets. Amazon transactions also tend to be quite large, with a diverse range of fees you need to consider (accounting software can help with this, but it opens the door to other issues, too). And we’re not even getting into tax liabilities!

During my career, I have worked with more than 8,000 Amazon sellers and their accountants. And during that time, I noticed a few common things that even the experts always seem to get wrong. But do you know what the worst part is? They didn’t even know they were making a mistake! The books never entirely balanced out, but they couldn’t put their finger on what exactly was missing. That is until it was too late.

Why Getting Amazon Bookkeeping Right Can Lead to New Opportunities

As an Amazon seller, you might see bookkeeping as a necessary evil. However, there’s a different way to look at it, one that is much more satisfying. Amazon accounting can, in fact, be an excellent way for you to understand how your business can make better profits! Because at the end of the day, sure, we all want to make people’s lives better by giving them access to wonderful products. But we’re here to grow a business.

If you’re getting Amazon accounting wrong, you’re not just at risk of paying more taxes than you’re due. You’re also missing out on profits and opportunities for growth. So, let’s go through common mistakes Amazon sellers make when managing their bookkeeping – and how to fix them.

The Three Most Common Amazon FBA Accounting Mistakes

We all make mistakes, but luckily, when it comes to Amazon, I might know exactly what the most common ones are. Below, you will find the top three mistakes people make when doing their accounting for Amazon.

Confusing their Net Deposits with Sales

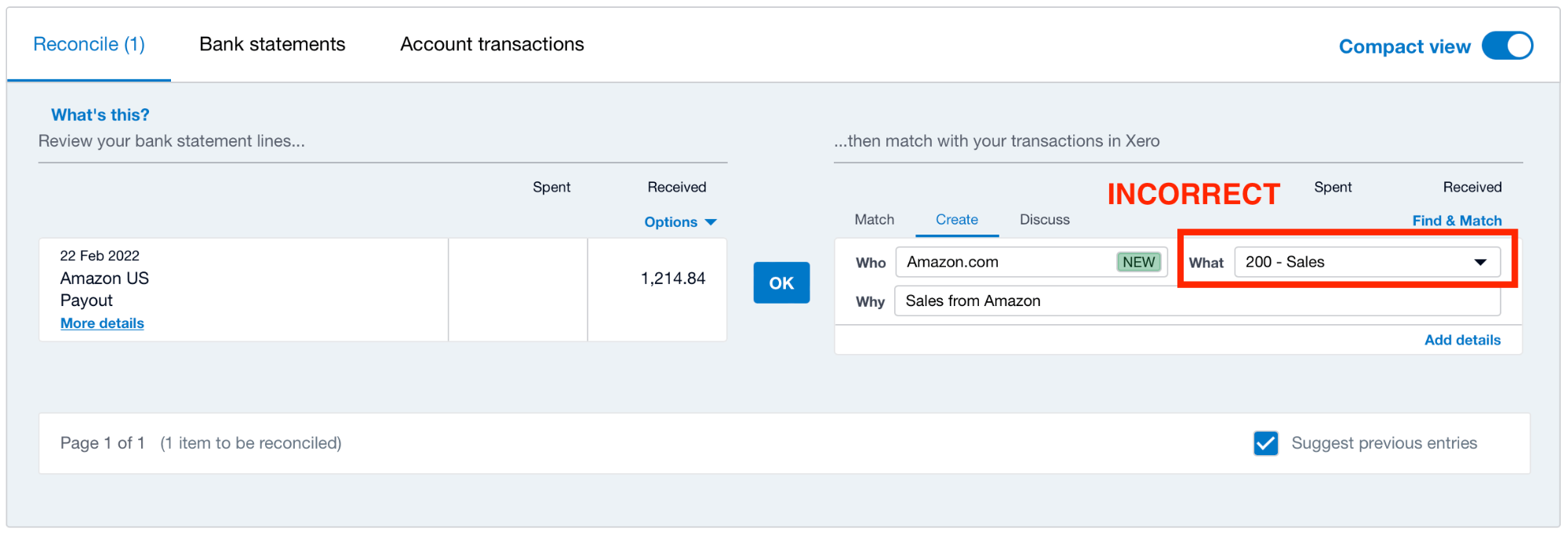

One of the most common errors when doing your Amazon accounting is entering your net deposits as sales. How does this happen? Simple. You see the amount of money that was deposited in your bank account, and you enter that same number as your sales figure. This is wrong!

Amazon deposits are made up of different types of transactions, which include:

- Amazon Refunds

- Amazon Sales

- Amazon Sellers Fees

- Amazon Storage Fees

- Amazon FBA Reimbursements

- Amazon FBA Fees

- Amazon Lending

- Amazon PPC (Pay Per Click or Advertising Costs)

- Amazon Reserved Balances

So, what happens if you turn all of these Amazon transactions into a net deposit? You basically put yourself at risk of over-declaring or under-declaring your profits. Eventually, this can lead to paying too much VAT, if you’re VAT registered in the UK, or tax for sellers based in the US.

How to Fix this Issue: You need to account for all of the different transaction types separately in order to get an accurate picture of your profitability and maintain accurate books. If you want to keep a close eye on how fees are changing (for instance, if they are rising), you should always separate your Amazon fees by type. For example, suppose you have a high storage fee for a given month. In that case, one thing you could do is see which inventory has been stored for more than 90 or 180 days and run a quick sale to clear it out so you can pay lower storage fees the next month.

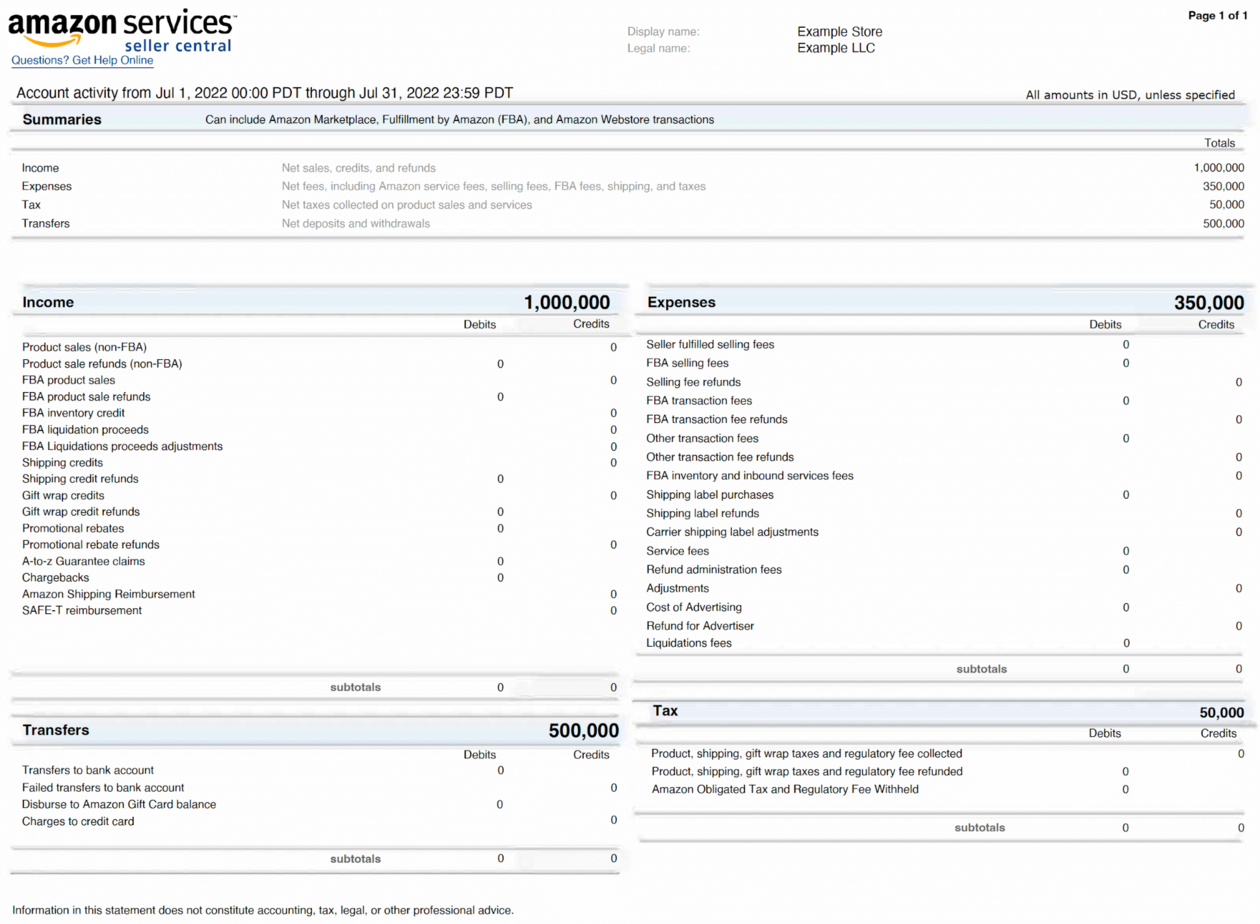

Misusing Your Amazon Date Range Summary File

Another common Amazon accounting mistake I’ve seen more than one business owner make is downloading your Date Range Summary report each month and entering the Income and Expenses totals directly onto your accounting software. The problem here is that your Amazon deposits will never match your income. Why? Because Amazon pays every 14 days, so you will never be entirely sure the figures are accountable.

How to Fix this Issue: Just avoid using Amazon’s date range summary reports to calculate what should go into the Income and Expenses within your accounting software program. Instead use the settlement reports in combination with the VAT reports (if you’re based in the UK) to ensure that you are capturing all the data correctly.

Applying the Same GST or VAT to All Sales

Lastly, the third typical mistake when doing Amazon accounting is not separating your export sales and common sales where Amazon has already remitted the tax to a country’s tax authorities. This is especially the case if you’re using Amazon Fulfillment or FBA (a program that automatically handles all shipping and product returns).

Amazon FBA turns on the Global Shipping Program by default, so unless you opt-out, your products’ entire life cycle will be handled by the platform. This means that Amazon will directly treat your sales that go to customers in other countries as exports and classify them as Free Income GST (for Australian sellers) or Zero Rated VAT (for UK sellers).

How to Fix this Issue: Make sure you correctly identify and separate any sales to customers abroad that are fulfilled through the Amazon FBA program. Many FBA sellers don’t do so and end up paying more GST or VAT than they should and right out of their pockets.

General Tips for Avoiding Amazon Accounting Mistakes

We covered three common Amazon accounting mistakes (which you might or might not have already been making). So, you might be wondering now what is the best way to make sure your books are clear. My advice for ensuring you’re always paying the right amount of tax can be summed up in these three points:

- Use the correct reports.

- Be detailed but don’t overdo it.

- Consider adding automation to your accounting.

Let’s go through each of these in a little more detail, shall we?

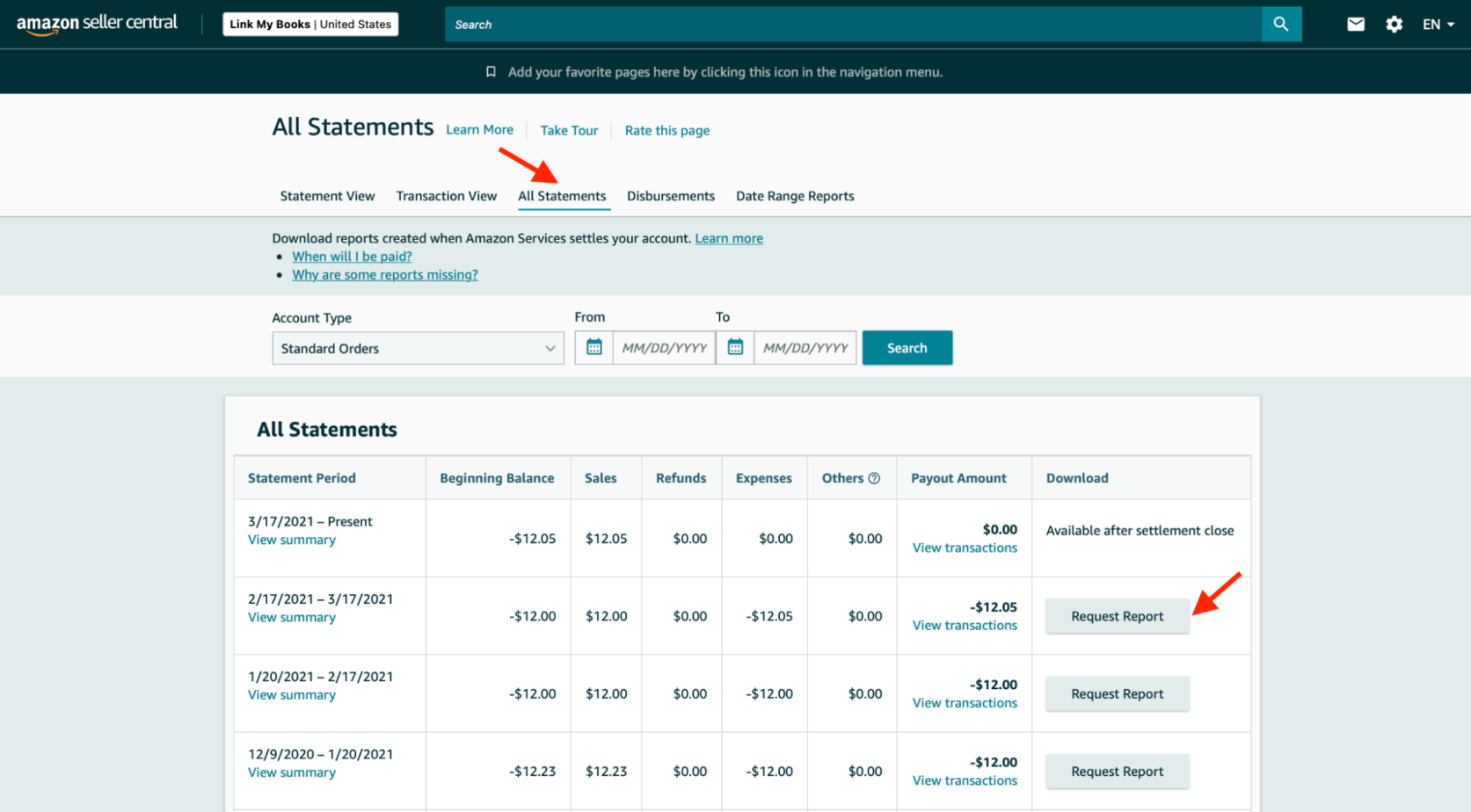

Using the Best Reports for Each Case

The key to keeping your bookkeeping clear is to know which reports you should use for which tasks so you know at each point exactly what your fees, sales, refunds, and transactions are. If you’re a new Amazon seller, one good way to do this is to spend at least half a day each month looking at these numbers and ordering them in spreadsheets.

You can do this relatively easily by using Amazon’s settlement report, which lists all transactions for a period of time (your Amazon payouts period). You can easily download this report by going to Amazon Seller Central Account and then clicking on Reports > Payments > All statements.

You can use Microsoft Excel to sort the different transaction types and then migrate the information to your accounting software of choice.

Important Note: For UK businesses, make sure you also use the Amazon VAT Transactions Report. This will help you see the export sales and sales where Amazon has already collected VAT and sent it to the HMRC. For Australian businesses, you can use the All Orders report to see which items were shipped outside the country so you can apply the correct GST rates to them.

Being Detailed Without Overdoing It

Accounting is no easy task, so on the one hand, you will want to make sure you are working with a good level of detail for all your fees and transactions. This can, no doubt, help you identify and pay the correct amount of tax and find good opportunities for growth. However, when it comes to Amazon accounting, there is such a thing as too much detail. I like to call it analysis paralysis!

It can be tempting to split out every single transaction type and fee, but this will only lead to you wasting time and making your life harder than it should be. There is a healthy balance between too little and too much data. You should make sure you have enough information to make good decisions without overwhelming yourself with unnecessary details.

Using Accounting Automation

My last bit of advice is very straightforward: Don’t be scared of automation, for it can help you free up time and uncover new information you can use to grow your business. And, without trying to be offensive, in many cases, automation can even do a better job than you will.

One of the risks of doing your own Amazon accounting is that, apart from taking considerable time and being complex, it’s also terribly boring. Nobody wants to squander hours downloading and analysing reports and then moving them to cloud software. In fact, Amazon itself says that if you’re spending more than ten minutes a month doing your books, you’re wasting your time.

Luckily, there are many tools you can use to automate most, if not all, of your Amazon accounting. This will not just make your calculations more accurate; it will also ensure you never pay more tax than you’re supposed to.

The Best Amazon Accounting Software Automation

You don’t need to pay an accountant large amounts of money to handle your Amazon bookkeeping. By using a service like Link My Books, you can automate all essential tasks in just a couple of clicks.

So, if you’re a business owner and you want to make sure your books are in order, start by committing yourself not to waste any more time spending hours reconciling your Amazon payouts. Try automation today so you can focus on what matters the most: Growing your business.