Analyze demand, competition, and profits to discover winning eBay products in minutes.

Track marketplace trends, seasonality, and revenue shifts to plan inventory with confidence.

Explore millions of listings with advanced filters to spot untapped product opportunities fast.

Instantly reveal eBay's current best-selling items for quick inspiration and store growth.

Uncover competitors' best sellers, pricing strategies, and sales volume for strategic advantage.

Research eBay keywords in detail, analyze sales and search volume, and generate optimized titles.

Compare supplier prices and shipping to source profitable dropshipping products effortlessly.

AI lists high-profit items and schedules scans, automating your product research workflow.

Bulk-analyze hundreds of items simultaneously to evaluate demand, margins, and competition.

Ultra-fast scanner crunching thousands of listings for real-time market opportunities.

Analyze demand, competition, and profits to discover winning eBay products in minutes.

Discover top-performing Facebook and Instagram ads to model winning campaigns.

Monitor competitors' daily sales and revenue data to validate product demand.

Browse millions of listings to uncover trending Shopify products with powerful filters.

Identify high-revenue stores in any niche and analyze their strategies instantly.

Track keyword trends, seasonal demand, and price shifts across the Shopify marketplace.

Generate a fully functional Shopify store that's ready for your customers in few minutes.

Send selected products to AutoDS for automated fulfillment and inventory syncing.

Push winning items to Dropshipman for seamless order processing and supplier management.

Analyze demand, competition, and profits to discover trending products for your Shopify store in minutes.

We teach you from zero to savvy to maximize your ZIK investment for ecommerce growth.

We teach you from zero to savvy to maximize your ZIK investment for ecommerce growth.

We teach you from zero to savvy to maximize your ZIK investment for ecommerce growth.

Analyze demand, competition, and profits to discover winning eBay products in minutes.

Track marketplace trends, seasonality, and revenue shifts to plan inventory with confidence.

Explore millions of listings with advanced filters to spot untapped product opportunities fast.

Instantly reveal eBay's current best-selling items for quick inspiration and store growth.

Uncover competitors' best sellers, pricing strategies, and sales volume for strategic advantage.

Research eBay keywords in detail, analyze sales and search volume, and generate optimized titles.

Compare supplier prices and shipping to source profitable dropshipping products effortlessly.

AI lists high-profit items and schedules scans, automating your product research workflow.

Bulk-analyze hundreds of items simultaneously to evaluate demand, margins, and competition.

Ultra-fast scanner crunching thousands of listings for real-time market opportunities.

Analyze demand, competition, and profits to discover winning eBay products in minutes.

Discover top-performing Facebook and Instagram ads to model winning campaigns.

Monitor competitors' daily sales and revenue data to validate product demand.

Browse millions of listings to uncover trending Shopify products with powerful filters.

Identify high-revenue stores in any niche and analyze their strategies instantly.

Track keyword trends, seasonal demand, and price shifts across the Shopify marketplace.

Generate a fully functional Shopify store that's ready for your customers in few minutes.

Send selected products to AutoDS for automated fulfillment and inventory syncing.

Push winning items to Dropshipman for seamless order processing and supplier management.

Analyze demand, competition, and profits to discover trending products for your Shopify store in minutes.

We teach you from zero to savvy to maximize your ZIK investment for ecommerce growth.

We teach you from zero to savvy to maximize your ZIK investment for ecommerce growth.

We teach you from zero to savvy to maximize your ZIK investment for ecommerce growth.

eBay Fee Calculator

Use free eBay Fee Calculator to quickly estimate final value, insertion, shipping and promotion fees so you can calculate profit margins before you list. Updated for 2026 managed payments and seller levels.

Filters

Sales Tax

More Options

Your Profit

Enter sold price to calculate profit

Profit & Fees Breakdown

- Sold Price:

- —

eBay Transaction Fees

- Final Value Fee

- 0.00%

- Fixed Transaction Fee

- $0.30

- Promotion Fees

- 0.00%

- Total eBay Fees

- $0.30

- Total eBay Fees %

- 0.00%

Other Costs

- Item Cost

- $0

- Shipping Cost

- $0

- Other Costs

- $0

- Total Cost

- $0

- Total Cost %

- 0.00%

Charged to Buyer only

Try more of our Tools

TrustScore 4.8 | 724 Reviews

ZIK Analytics is rated EXCELLENT

eBay Fee Calculator & Fees Frequently Asked Questions

How much does eBay take in fees?

It depends. eBay charges insertion fees plus a final value fee (a percentage of the sale plus a small per-order fixed fee), and you may also pay promotion, international, or optional-listing fees. Total take commonly ranges by category and volume.

How are fees calculated on eBay?

Fees are typically calculated on the Total Sale (item price + shipping + tax where applicable). Final value fees use that base; insertion fees apply when free allowances are used; extra charges (promoted listings, international, upgrades) are added separately.

What percentage does eBay take?

Percentages vary by category, price bands, and Store level. Many common categories sit in the ~9–15% range depending on tiers and caps (for example ~12.7% or 13.6% bands), but exact rates require a category lookup.

How does eBay calculate the final value fee?

Final value fee = (Total Sale × final-value-rate) + per-order fixed fee (typically $0.30 for orders ≤ $10 or $0.40 for orders > $10). Total Sale normally includes item price, buyer-paid shipping, and applicable taxes.

How do I avoid eBay fees?

Legally reduce fees by choosing the right category and listing format, using free insertion allocations or a Store subscription, optimizing shipping and promo spend, and tracking ROI. Do not solicit off-platform sales, fee-avoidance breaches eBay policy.

Why are eBay fees so high?

Fees fund marketplace services: listing infrastructure, buyer reach, fraud protection, payment processing, and support. Complexity (category bands, per-order charges, promotions) makes them feel high, especially when shipping or tax is included in the fee base.

Does eBay charge you if an item doesn’t sell?

Yes, insertion fees apply when you create a listing and are generally nonrefundable if the item does not sell. Some optional fees (reserve, subtitle) are charged regardless; fee credits exist in limited cases per eBay’s policy.

What are the eBay Managed Payment fees?

Managed Payments consolidates payment processing into eBay’s platform; sellers pay a processing fee that is typically a percentage plus a fixed per-transaction amount. Exact rates depend on the country and payment method, see your seller account for your rate.

Is it worth paying for an eBay store subscription?

Often yes for medium-to-high volume sellers. Stores give larger free listing allowances, lower insertion costs and reduced final-value tiers in many categories; for low-volume sellers it may not pay back. Evaluate months-to-payback using your listing volume.

Do we still need to worry about PayPal fees?

Mostly no for standard eBay transactions. eBay now uses Managed Payments, so PayPal is no longer the default payout method; sellers should check their payment settings and compare managed-payment processing rates versus any remaining PayPal use cases.

Who pays for shipping on eBay?

It depends on the listing. Sellers choose whether the buyer pays shipping or the seller offers free shipping. The checkout/payment selection determines which service and who pays, so set shipping options clearly in your listing.

On this page

Current eBay Fees 2026

Here are the latest eBay fee charges for every category.

Stores Without a Subscription

At-a-glance fee breakdown for sellers using eBay without a Store subscription. It shows insertion fees and final-value fee percentages by category so you can estimate net revenue. It is useful to pair with our eBay fee calculator for precise totals. For eBay official selling fees, visit the page here.

| Category | SubCategory | Insertion Fees | Final value fee % + per order fee |

|---|---|---|---|

| Most Categories | Including:

| First 250 listings free per month, then $0.35 per listing |

|

| Books & Magazines |

| ||

| Movies & TV | (except Movie NFTs) |

| |

| Music | (except Vinyl Records and Music NFTs categories) |

| |

| Coins & Paper Money | Bullion |

| |

| Clothing, Shoes & Accessories | Women > Women's Bags & Handbags |

| |

| Collectibles | Comic Books & MemorabiliaNon-Sport Trading Cards |

| |

| Sports Mem, Cards & Fan Shop | Sports Trading CardsToys & Hobbies > Collectible Card Games |

| |

| Jewelry & Watches | Watches, Parts & Accessories |

| |

| Everything else |

| ||

| NFT | Art NFTsCCG NFTsEmerging NFTsMovie NFTsMusic NFTsNon-Sport Trading Card NFTsSport Trading Card NFTs |

| |

| Business & Industrial | Heavy Equipment Parts & Attachments > Heavy EquipmentPrinting & Graphic Arts > Commercial Printing PressesRestaurant & Food Service > Food Trucks, Trailers & Carts | $20 |

|

| Musical Instruments & Gear | Guitars & Basses | Free |

|

| Clothing, Shoes & Accessories | Men > Men's Shoes > Athletic ShoesWomen > Women's Shoes > Athletic Shoes | Free if starting price is $150 or more* |

|

* Starting price is the starting price (auction-style listings) or Buy It Now price (fixed price listings) of your listing, and doesn't include shipping, handling, taxes, or fees Rates vary by country, condition, and promotions. Use the eBay fee calculator above for an item-level calculation.

eBay Fees with Store Subscription

Summary of monthly Store subscription costs, zero-insertion listing allocations, insertion fees after allocations, and typical final-value fee tiers for eBay Store subscribers on eBay.com. Excludes Promoted Listings, payment processing fees, and taxes.

| Store type | Monthly fee (monthly/annual) | Zero insertion listings, Auction-style | Zero insertion listings, Fixed price | Insertion fee after allocation (typical) | Common final-value fee example (typical categories) |

|---|---|---|---|---|---|

| Starter | $7.95 / $4.95 | 250 | — (small / selected categories only) | ≈ $0.30 per listing | 13.6% on sale up to $7,500 + 2.35% over |

| Basic | $27.95 / $21.95 | 250 (select categories) | 1,000 (all categories) + 10,000 (select categories) | ≈ $0.25 per listing | ~12.7% on sale up to $2,500 + 2.35% over (many categories) |

| Premium | $74.95 / $59.95 | 500 (select categories) | 10,000 (all) + 50,000 (select) | ≈ $0.10–$0.15 per listing | ~12.7% on sale up to $2,500 + 2.35% over (many categories) |

| Anchor | $349.95 / $299.95 | 1,000 (select categories) | 25,000 (all) + 75,000 (select) | ≈ $0.05–$0.10 per listing | Often 12.7% up to $2,500 or lower for specific categories |

| Enterprise | Not currently available / $2,999.95 (annual shown) | 2,500 (select categories) | 100,000 (all) + 100,000 (select) | ≈ $0.05 per listing (after allocation) | Lowest insertion rates; FVF tiers similar/lower depending on category |

Below are two comprehensive tables you can paste into your content: one for Starter Store subscribers and one for Basic / Premium / Anchor / Enterprise Store subscribers. Each row lists the category (or subcategory), the final-value fee (FVF) structure for that Store level, and a short “notes” cell for insertion-fee / allocation / per-order fee exceptions where applicable.

Starter Store Subscription: Final value fees & notes

| Category / Subcategory | Final value fee (Starter Store) | Notes |

|---|---|---|

| Most categories (including eBay Motors > Parts & Accessories, Automotive Tools & Supplies, Safety & Security Accessories) | 13.6% on total amount of sale up to $7,500 (calculated per item); 2.35% on portion over $7,500 | Per-order fee applies: $0.30 for orders ≤ $10; $0.40 for orders > $10. Zero-insertion allocations: Starter: 250 auction-style (select categories), fixed-price allocations limited/select. |

| Books & Magazines | 15.3% on total amount up to $7,500; 2.35% over | Same per-order fee rules. |

| Movies & TV (except Movie NFTs) | 15.3% on total amount up to $7,500; 2.35% over | — |

| Music (except Vinyl Records and Music NFTs categories) | 15.3% on total amount up to $7,500; 2.35% over | — |

| Coins & Paper Money (except Bullion) | 13.25% on total amount up to $7,500; 2.35% over | — |

| Coins & Paper Money › Bullion | 13.6% if total ≤ $7,500; 7% on portion over $7,500 | — |

| Select Collectibles (Comic Books & Memorabilia; Non-Sport Trading Cards; Sports Mem, Cards & Fan Shop › Sports Trading Cards; Toys & Hobbies › Collectible Card Games) | 13.25% on total amount up to $7,500; 2.35% over | Select-collectibles treatment. |

| Musical Instruments & Gear › Guitars & Basses | 6.7% on total amount up to $7,500; 2.35% over | All listings appropriate to this category are not subject to insertion fees in general (see insertion fee exceptions). |

| Jewelry & Watches (except Watches, Parts & Accessories) | 15% if total ≤ $5,000 (per item); 9% if total > $5,000 (per item) | Calculated per item. |

| Jewelry & Watches › Watches, Parts & Accessories | 15% on total up to $1,000 per item; 6.5% on portion over $1,000 up to $7,500; 3% on portion over $7,500 | Tiered bands. |

| NFT categories (Art NFTs; CCG NFTs; Emerging NFTs; Movie NFTs; Music NFTs; Non-Sport Trading Card NFTs; Sport Trading Card NFTs) | 5% on total amount of sale | No per-order addition beyond per-order fee rules where applicable. |

| Select Business & Industrial (Heavy Equipment Parts & Attachments › Heavy Equipment; Printing & Graphic Arts › Commercial Printing Presses; Restaurant & Food Service › Food Trucks, Trailers & Carts) | 3% on total amount up to $15,000; 0.5% on portion over $15,000 | Note: These categories have a $20 insertion fee listed elsewhere for some Store types, check insertion rules. |

| Clothing, Shoes & Accessories › Women › Women's Bags & Handbags | 15% if total ≤ $2,000 (per item); 9% if total > $2,000 | — |

| Clothing, Shoes & Accessories › Men › Men's Shoes › Athletic Shoes | 8% if total ≥ $150 (per item); 13.6% if total < $150 | If starting price/Buy It Now ≥ $150, per-order fee is not charged for the higher-tier rate. Starter lists may have free starting-price exemption for some listings. |

| Clothing, Shoes & Accessories › Women › Women's Shoes › Athletic Shoes | Same as Men's Shoes above | — |

| Business & Industrial, Everything else (general) | 15% if total ≤ $5,000; 9% if total > $5,000 | Where "Everything else" rules apply. |

| Musical Instruments & Gear (general categories) | Varies (see guitars special rate above; other subcategories may follow most-categories rate) | Check specific subcategory lines for exact rates. |

| Misc / All other categories not listed above | 15% if total ≤ $5,000; 9% if total > $5,000 OR 13.6% up to $7,500 in categories that use that band, confirm by specific category | Starter-level category mapping contains exceptions; use category-specific rule. |

Basic / Premium / Anchor / Enterprise Stores, Final value fees & notes

| Category / Subcategory | Final value fee (Basic / Premium / Anchor / Enterprise) | Notes |

|---|---|---|

| Antiques | 12.7% on total amount up to $2,500; 2.35% on portion over $2,500 | Per-order fee: $0.30 (≤$10) / $0.40 (>$10). Zero-insertion allocations larger than Starter. |

| Most Art categories (except some exceptions) | 12.7% on total up to $2,500; 2.35% over | Art NFTs remain at 5% where specified. |

| Baby | 12.7% on total up to $2,500; 2.35% over | — |

| Books & Magazines | 15.3% on total up to $2,500; 2.35% over | Note: Basic+ shifts cap from $7,500 down to $2,500 for many categories. |

| Most Business & Industrial categories (except heavy equipment / printing / food trucks) | 12.7% on total up to $2,500; 2.35% over | Heavy-equipment and other large-equipment categories have different bands (see below). |

| Heavy Equipment, Parts & Attachments › Heavy Equipment; Printing & Graphic Arts › Commercial Printing Presses; Restaurant & Food Service › Food Trucks, Trailers & Carts | 2.5% on total amount up to $15,000; 0.5% on portion over $15,000 | Lower percentage bands for these business/industrial heavy items. |

| Most Cameras & Photo categories (except some listed exceptions) | 9.35% on total up to $2,500; 2.35% over | Exceptions: some accessories and replacement parts differ. |

| Camera accessories & certain parts | 12.7% on total up to $2,500; 2.35% over | Category-specific exceptions apply. |

| Most Cell Phones & Accessories categories (except specified exceptions) | 9.35% on total up to $2,500; 2.35% over | Certain phone accessory subcategories follow the 12.7% band. |

| Most Clothing, Shoes & Accessories categories (general) | 12.7% on total up to $2,500; 2.35% over | Women's Bags & Handbags have a special band (see below). |

| Women › Women's Bags & Handbags | 13% if total ≤ $2,000; 7% if total > $2,000 | Different banding vs the general 12.7% up-to-$2,500 rule. |

| Men's Shoes / Women's Shoes › Athletic Shoes | 7% if total ≤ $150 (per item), per-order fee not charged; 12.7% if total < $150 | Improved rate for higher-priced athletic shoes under Basic+. |

| Most Coins & Paper Money categories (except some exceptions) | 9% on total up to $4,000; 2.35% over | Note: bullion has separate tiers (below). |

| Bullion (coins & paper money › bullion) | 7.5% if total ≤ $1,500; 5% if total > $1,500 up to $10,000; 4.5% if total > $10,000 | Multi-tier bands for bullion. |

| Most Collectibles categories (general) | 12.7% on total up to $2,500; 2.35% over | Select collectible subcategories have slightly different bands. |

| Comic Books & Memorabilia; Non-Sport Trading Cards | 12.35% on total up to $2,500; 2.35% over | Slightly lower rate for some collectible subcategories. |

| Emerging NFTs; Non-Sport Trading Card NFTs | 5% on total amount | NFT-specific flat 5% where applicable. |

| Most Computers / Tablets & Networking categories (except some exceptions) | 9.35% on total up to $2,500; 2.35% over | Some subcategories (desktops, laptops) have 7.35% band (see below). |

| Desktops & All-In-Ones; Laptops & Netbooks; Tablets & eBook Readers; Computer Components & Parts: (selected high-demand subcategories) | 7.35% on total up to $2,500; 2.35% over | Specific product-class reductions for high-value consumer computing devices. |

| Most Consumer Electronics categories (general) | 12.7% on total up to $2,500; 2.35% over | Many popular electronics categories have special 9.35% or 7.35% bands for certain subcategories. |

| Most Movies & TV categories (except movie-NFTs) | 15.3% on total up to $2,500; 2.35% over | Movie NFTs remain at 5% for NFT line. |

| Most Music categories (except vinyl and music-NFTs) | 15.3% on total up to $2,500; 2.35% over | Vinyl Records have a reduced band: 12.7% up to $2,500 + 2.35% over. Music NFTs = 5%. |

| Most Musical Instruments & Gear categories (except specific) | 10.35% on total up to $2,500; 2.35% over | DJ/Pro Audio Equipment exceptions: 9.35% up to $2,500 + 2.35% over. Guitars & Basses: 6.7% up to $2,500 + 2.35% over. |

| Pet Supplies; Pottery & Glass; Specialty Services; Sporting Goods; Most Sports Mem, Cards & Fan Shop categories | 12.7% on total up to $2,500; 2.35% over | Sports trading cards special sub-bands exist. |

| Sports Trading Cards (select) | 12.35% on total up to $2,500; 2.35% over | Slightly reduced band. |

| Stamps | 9.7% on total up to $2,500; 2.35% over | Lower band for stamps. |

| Most Toys & Hobbies categories (general) | 12.7% on total up to $2,500; 2.35% over | Collectible Card Games (non-CCG NFTs) have 12.35% up to $2,500 + 2.35% over. |

| Most Video Games & Consoles categories (general) | 12.7% on total up to $2,500; 2.35% over | Video Game Consoles: 7.35% up to $2,500 + 2.35% over in specific console subcategory. |

| All other categories (catch-all) | 12.7% on total up to $2,500; 2.35% over | Basic+ general band. |

| eBay Motors › Automotive Tools & Supplies; Parts & Accessories; Safety & Security Accessories (motors exceptions) | 11.5% on total up to $1,000; 2.35% over | Certain eBay Motors parts subcategories (e.g., tires) have 9.5% up to $1,000 + 2.35% over; other parts may be 9.35% or 12.7% depending on subcategory. |

| eBay Motors › Parts & Accessories › Tires (specific lists enumerated) | 9.5% on total up to $1,000; 2.35% over | Tire subcategory special band. |

| Watches, Parts & Accessories (under Jewelry & Watches) | 12.5% on total up to $1,000; 4% on portion over $1,000 up to $5,000; 3% on portion over $5,000 | Different banding in Basic+. |

| Vinyl Records | 12.7% on total up to $2,500; 2.35% over | Music-category exception. |

| Music NFTs; Movie NFTs; Other NFTs where listed | 5% on total amount | NFT flat rate across Store levels where NFT category applies. |

| Misc / Additional exceptions | Many categories have targeted exceptions or alternate bands (see per-category listing) | See eBay for full per-category exceptions and exact subcategory mapping. |

Source: eBay Store selling fees, eBay Seller Help (eBay.com)

Universal per-order fee & insertion notes (applies to all Store levels unless noted)

- Per-order fee: For orders $10.00 or less the per-order fee is $0.30. For orders over $10.00 the per-order fee is $0.40, except where a specific category rule states the per-order fee is not charged (e.g., certain high-price athletic shoe listings when qualifying for the special rate).*

- Insertion fees / zero-insertion allocations: Store subscribers receive monthly zero-insertion listing allocations that vary by Store type (Starter → Enterprise). Once allocation is exhausted, insertion fees apply; typical approximate insertion fees after allocation (varies by Store tier): Starter ≈ $0.30, Basic ≈ $0.25, Premium ≈ $0.10–$0.15, Anchor ≈ $0.05–$0.10, Enterprise ≈ $0.05. Some categories (e.g., certain Musical Instruments › Guitars & Basses) are not subject to insertion fees. Enterprise subscribers can also earn or purchase additional zero-insertion fixed-price listing bundles.

- International, taxes, other fees: Final-value fee calculation includes item price + handling + shipping collected + sales tax (where applicable). International and currency-conversion charges, additional final-value fees for policy/performance issues, and optional listing upgrade fees are separate and may apply.

eBay Motor Fees

Summary of vehicle listing package fees and included features for eBay Motors (Cars & Trucks, Motorcycles, Powersports, Boats, Other Vehicles & Trailers). Shows Basic, Plus, and Premium package pricing, what’s included for auction vs fixed-price formats, deposit processing fee, and key terms.

| Package | Price | Auction format (included) | Fixed price format (included) | Notes |

|---|---|---|---|---|

| Basic | $19 | 20 photos; auction up to 7 days; AutoCheck (Cars & Trucks only) | 20 photos; duration up to 7 days; vehicle price cap: $10,000 (Cars & Trucks, Other Vehicles & Trailers, Boats); $5,000 (Motorcycles & Powersports); AutoCheck (Cars & Trucks only) | No final value fee when vehicle sells. Package fee charged at listing/relist; nonrefundable. |

| Plus | $49 | 30 photos; auction up to 7 days; reserve price up to $20,000 (Cars & Trucks/Other Vehicles/Boats) or $10,000 (Motorcycles/Powersports); AutoCheck (Cars & Trucks only) | 30 photos; duration up to 30 days; vehicle price cap: $20,000 (Cars & Trucks, Other Vehicles & Trailers, Boats); $10,000 (Motorcycles & Powersports); AutoCheck (Cars & Trucks only) | Includes higher reserve limits and longer fixed-price duration. |

| Premium | $79 | 40 photos; Gallery Plus upgrade; auction up to 10 days; unlimited reserve; Add "Buy It Now"; AutoCheck (Cars & Trucks only); bold title & subtitle upgrades | 40 photos; Gallery Plus upgrade; duration up to 30 days; unlimited vehicle price; AutoCheck (Cars & Trucks only); bold title & subtitle upgrades | Highest feature bundle (Gallery Plus, bold title, subtitle, Buy It Now). |

Deposit processing fee

- Rate: 2.8% of the deposit amount (charged when the buyer pays the deposit in checkout and the vehicle sells).

- How it’s handled: The deposit processing fee is deducted from the deposit before payout to the seller. Deposits from buyers with a registered address outside the US may also be subject to an International fee.

- Example: Buyer deposit = $500 → Deposit processing fee = $14.00 (2.8%) → Deposit funds paid out to seller = $486.00.

Other key terms and short notes

- No final value fee: eBay does not charge a final value fee for vehicle listings when the vehicle sells, the package fee covers the listing.

- Package fees charged per listing: Package fees apply to each vehicle listing created and are charged at the time the listing goes live or when relisted (if auto-relist is used). Fees are nonrefundable.

- Listing format limits: Fixed-price and auction formats have different included durations and price caps depending on package and vehicle type (see table above).

- Dealer subscriptions: Professional dealers can subscribe to monthly vehicle plans and may include features such as AutoCheck, contact eBay for dealer subscription details.

- Currency & sites: Fees shown are for eBay.com and are in USD. Other eBay sites (country-specific) may have different fees.

- Taxes & local fees: Sales tax, VAT/GST, or other consumption taxes may apply per local law, tax treatment of fees appears on your monthly invoice.

- Search & visibility: In some cases a new listing may take up to 24 hours to appear in search results. Listing durations and display placements are not guaranteed.

- Optional upgrades: There are no additional listing upgrade options beyond those included in the selected Motors package for vehicle listings.

How to Calculate Your eBay Fees Using an eBay Fee Calculator

There are 2 ways to use the eBay fee calculator:

1. You can copy the eBay Item ID for the product you want to sell and paste it into the Item ID field. The eBay fee calculator will pull the price & category from eBay and will calculate the fees and profit based on this.

To make sure you get accurate results please make sure to choose the relevant information from the filters (store subscription, top rated seller, etc)

2. You can fill your product selling price, shipping cost, product cost and all other filters (store subscription, top rated seller and etc) and you will immediately get the results.

For the second step, follow clear steps to input correct values, check the fee breakdown, run scenarios, and find your break-even price before you list. Here is the step by step guide:

- Select the marketplace: Choose the eBay site you sell on, for example eBay.com, so the calculator applies the right currency and regional fee rules that determine percentages and per-order charges for your listing.

- Pick the item category: Choose the most accurate category or subcategory so the calculator applies the correct final value fee band, subcategory exceptions, and any special per-category rules that change fee calculations.

- Enter the item sold price: Type the buyer-facing sale price or Buy It Now amount; this number is the base for final value fees and may include shipping and applicable sales tax depending on regional rules.

- Enter your item cost: Record the purchase price, materials, and direct labor so the calculator computes a real net margin and prevents inflated profit estimates from inaccurate cost assumptions.

- Confirm or adjust the eBay fee percentage: Let the tool auto-fill the final value fee from category and store level, and override it when you know a specific tier, promotion, or special rate for the precise fee calculation.

- Enter the shipping charge (buyer pays): Add the amount charged to the buyer; many marketplaces include shipping in the sale total so this figure can increase the final value fee and change the payout calculation.

- Enter the shipping cost (you pay): Include your true shipping expense, packaging, and label fees; subtracting real shipping cost produces an honest profit figure and highlights opportunities to optimize fulfillment.

- Enter promotion percentage: Specify the percent you pay for Promoted Listings or ads; promotion fees are usually a percentage of the sale and directly reduce net profit on sold items.

- Enter other costs: List other per-item expenses such as returns, marketplace label fees, insurance, or handling so the calculator captures recurring costs that erode margins at scale.

- Select your eBay Store level: Pick Starter, Basic, Premium, Anchor, or Enterprise if you subscribe so the calculator applies zero-insertion allocations and reduced final value fee tiers where applicable.

- Select seller status: Choose performance status like Above Standard or Below Standard so any additional fee multipliers or penalties for service metrics are included in the calculation.

- Run the calculation: Click Calculate or let results update live; the tool combines inputs and outputs a fee breakdown, net payout, profit, and profit percentage for review.

- Read the Profit and Fees Breakdown: Check final value fee, fixed transaction fee, promotion fees, total eBay fees, other costs, total profit, and profit percentage to understand exactly where money is going.

- Check the break-even figure: Use the break-even price or margin the calculator provides to confirm the minimum selling price that covers fees and costs before you list.

- Run scenarios and compare: Change one variable at a time, like promotion %, shipping cost, or store tier, and recalculate to see which changes most improve margin and where to focus optimization.

Use the fee calculator to test pricing and promotion scenarios before listing. Keep fee inputs current, compare store levels and ad spends, and save exported results to track what pricing choices actually deliver the margins you need.

Typical eBay Fees Included in an eBay Selling

When you sell on eBay, the final payout is the result of several separate fees and costs piled together. Below is a clear list of the common fees you will usually see on a sale, each with a short plain-English explanation so you know what to expect.

| Fee Type | What it is | How it's calculated | Who pays | Notes / Example |

|---|---|---|---|---|

| Final value fee (FVF) | The main marketplace fee charged when an item sells. | Percentage of the total amount of the sale (item price plus shipping and sometimes tax), plus a small per-order fixed fee. | Seller | Typical example: $100 item + $10 shipping = $110 total. If FVF = 12.7% → $110 × 12.7% = $13.97. Add per-order fee (e.g., $0.40). |

| Fixed transaction fee (per-order fee) | A small flat fee applied once per checkout. | Flat amount per order, not per item (varies by site). | Seller | eBay.com example: $0.30 for orders ≤ $10; $0.40 for orders > $10. |

| Insertion fee (listing fee) | Charged when you create a listing after free allocation is used. | Flat fee per listing, varies by category and Store subscription level. | Seller | Non-store sellers have limited free listings. Store subscribers get larger monthly free allocations. |

| Promotion fees (Promoted Listings) | Fees for marketplace advertising that boosts visibility. | Usually a percentage of the sale or a cost-per-click model depending on the ad type. | Seller | Enter your ad rate as a percent; promoted sale triggers the percentage charge on the final sale. |

| Payment processing / managed payments fee | Fee for handling buyer payments and payouts. | Percentage of the payout plus a fixed per-transaction charge, varies by country and payment method. | Seller | Example: 2.5% of the sale plus a small fixed amount. Check your country rate. |

| Shipping charge (buyer pays) | Amount the buyer is charged for shipping. | Set by seller or calculated by marketplace; may be included in the FVF base. | Buyer (charged), Seller (if seller covers cost) | If shipping is included in FVF base, the seller effectively pays FVF on shipping unless buyer covers it separately. |

| Shipping cost (seller expense) | The actual cost to ship the item, packaging, and handling. | Seller's real postage and packaging expense. | Seller | Subtracted from payout to compute net profit. Include insurance and label fees. |

| Currency conversion / international fee | Charges for cross-border selling and currency conversion. | Percentage applied when funds or fee collection requires currency conversion or when shipping abroad. | Seller | eBay example: international fee 1.65% in some cases, plus a conversion charge retained by the marketplace. |

| Return / refund fees | Costs related to returns and refunded transactions. | Marketplace may credit some fees; seller still bears return shipping and restocking costs in many cases. | Seller (usually) | Policies differ. Some marketplaces refund insertion fees for sold auctions for certain Store levels. |

| Additional final value fees (penalties) | Extra percentage fees for policy violations or poor performance. | Applied as a percentage on the total amount of the sale when triggered by policy or performance rules. | Seller | Examples: extra % for Below Standard seller status or for transacting off-platform. |

| Optional listing upgrades | Paid features to make listings stand out, such as Gallery Plus, subtitles, or listing in two categories. | Fixed fee per upgrade, varies by feature, format, and duration. | Seller | Upgrades can improve visibility but increase listing cost. Fees apply on each relist when listing renews. |

| Store subscription fee | Monthly or annual fee to run an eBay Store subscription. | Fixed subscription price by plan (Starter, Basic, Premium, Anchor, Enterprise). | Seller | Store benefits include larger free listing allocations and reduced insertion or FVF tiers in many categories. |

| Deposit processing fee (Motors) | Fee charged on buyer deposits for vehicle listings that require a deposit. | Percentage of the deposit amount, deducted from the deposit before payout. | Seller (fee deducted from deposit) | eBay Motors example: 2.8% of deposit. Example: $500 deposit → $14 fee → $486 payout. |

| Classified ad / real estate fee variations | Different fee model for classified ads and real estate listings. | Typically flat insertion and notice fees, often no final value fee. | Seller | Fees are format specific; real estate and classified ads follow separate tables. |

Know the fee types, enter accurate numbers into your calculator, and treat promotion and shipping charges as real costs. Small changes to shipping policy, promotion spend, or category choice often have outsized effects on margin. Use the calculator to test scenarios before you list.

eBay Fee Formula

This section breaks fees into clear variables and formulas so you can compute exact marketplace costs and net profit. Use the simplified formula for quick estimates and the detailed formula for precise, item-level calculations. Examples follow, with step-by-step arithmetic.

Key variables (define these before you calculate):

- P = item sale price (buyer pays for the item)

- S_b = shipping charged to buyer

- T = sales tax collected on the sale (if applicable and included in fee bases)

- f_fvf = final value fee rate (decimal, e.g., 12.7% = 0.127)

- fvf_fixed = final value per-order fixed fee (e.g., $0.40)

- ins_fee = insertion fee charged when free allocation is exhausted (per listing)

- promo_pct = promoted listings percentage (decimal)

- pp_rate = payment processing rate (decimal)

- pp_fixed = payment processing fixed amount per order (currency)

- intl_fee_pct = international fee percentage when applicable (decimal)

- deposit = buyer deposit amount for Motors listings (if used)

- deposit_proc_rate = deposit processing fee rate (e.g., 2.8% = 0.028)

- other_fees = optional listing upgrades, dispute fees, additional penalties, etc.

- COGS = cost of goods sold (your cost to buy or make the item)

- S_cost = shipping cost you pay (seller expense)

- Taxes_remitted = taxes you must remit to authorities (if you collected T)

Typical Formulas used by eBay Sellers

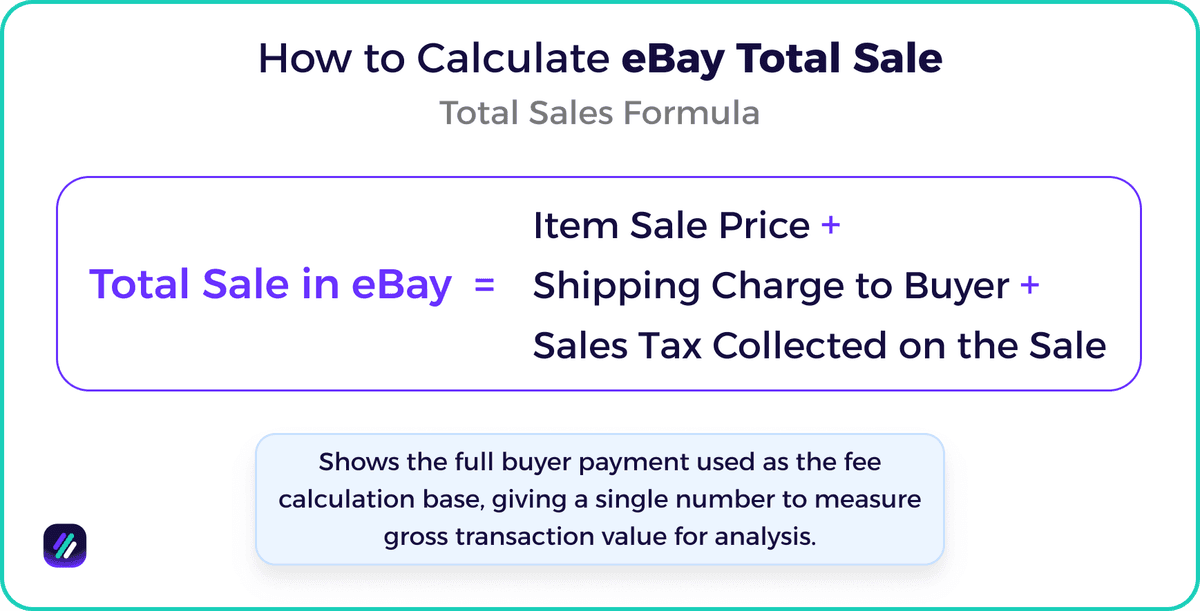

Total Sale = P + S_b + T

- Shows the full buyer payment used as the fee calculation base, giving a single number to measure gross transaction value for analysis.

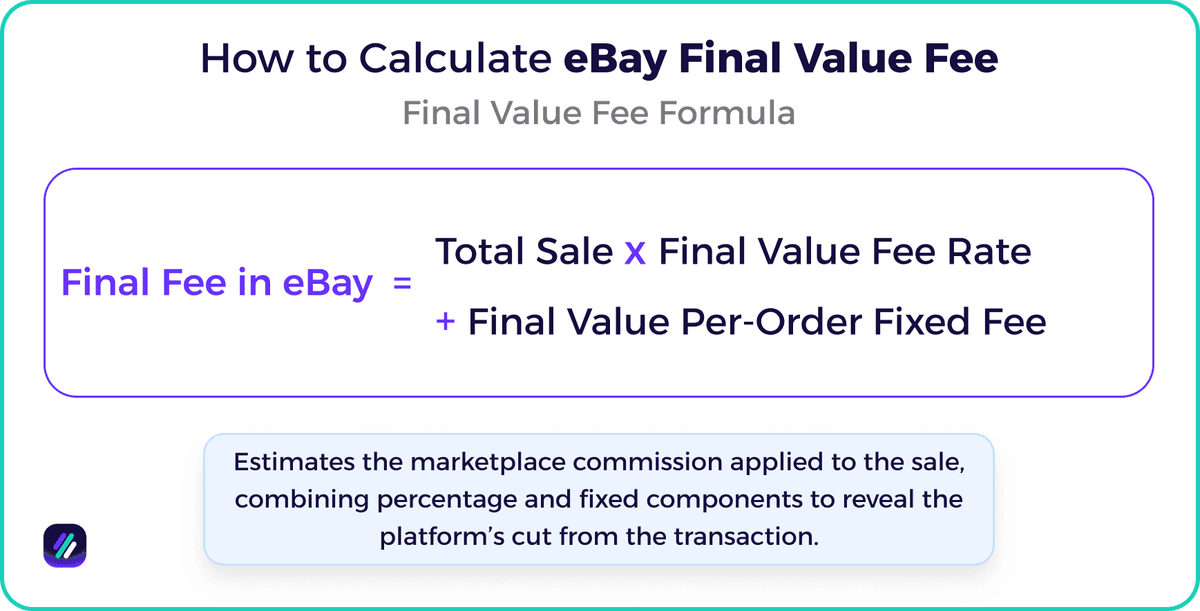

Final Value Fee = Total Sale × f_fvf + fvf_fixed

- Estimates the marketplace commission applied to the sale, combining percentage and fixed components to reveal the platform's cut from the transaction.

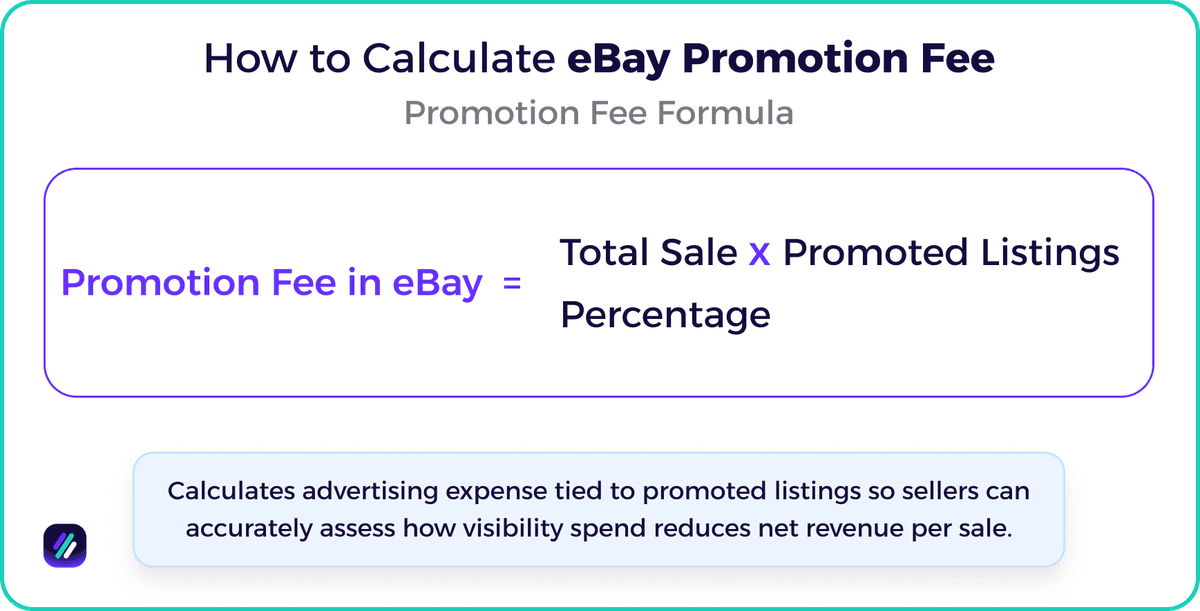

Promotion Fee = Total Sale × promo_pct

- Calculates advertising expense tied to promoted listings so sellers can accurately assess how visibility spend reduces net revenue per sale.

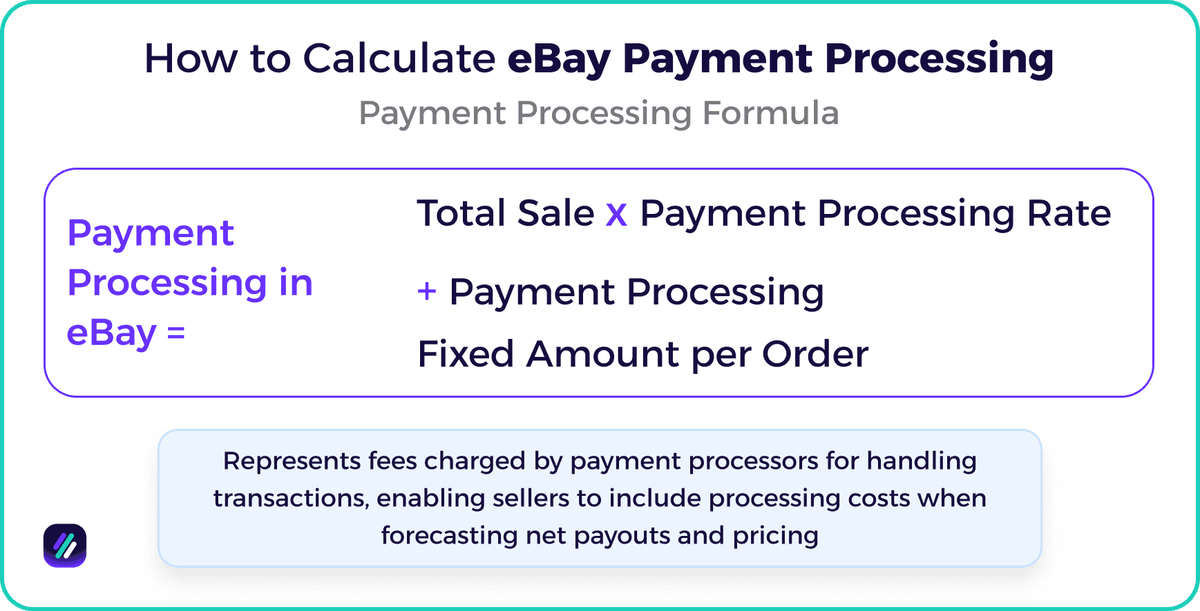

Payment Processing = Total Sale × pp_rate + pp_fixed

- Represents fees charged by payment processors for handling transactions, enabling sellers to include processing costs when forecasting net payouts and pricing.

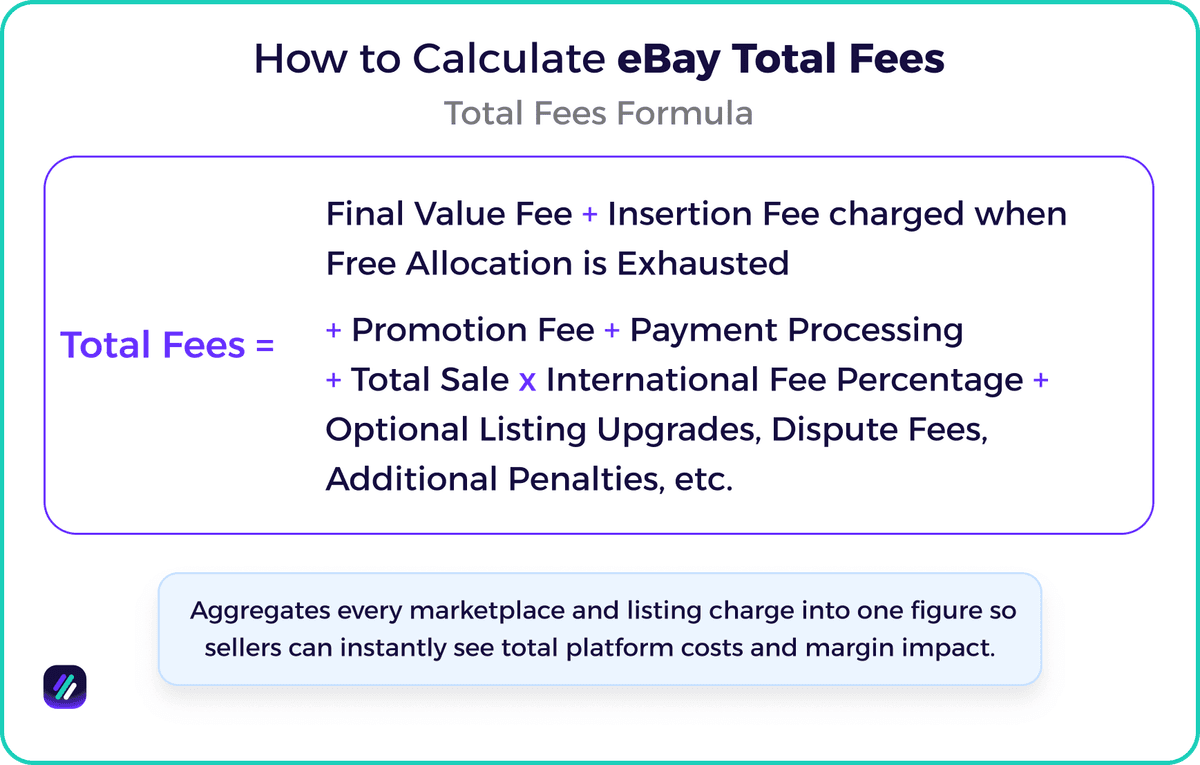

Total Fees = Final Value Fee + ins_fee + Promotion Fee + Payment Processing + (TotalSale × intl_fee_pct) + other_fees

- Aggregates every marketplace and listing charge into one figure so sellers can instantly see total platform costs and margin impact.

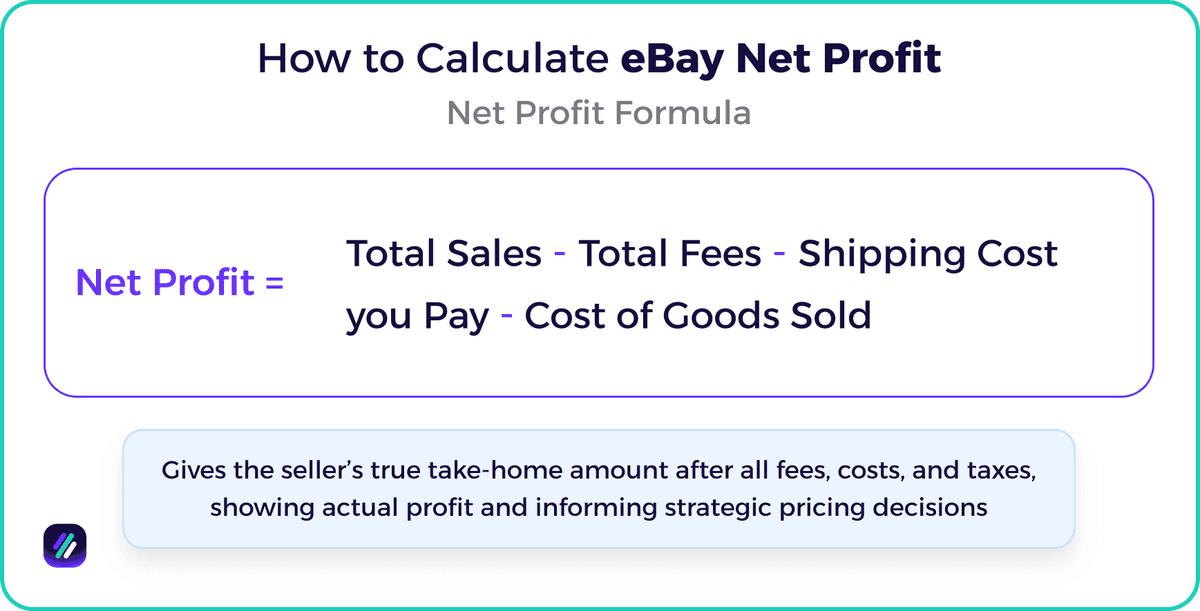

Net Profit = TotalSale - TotalFees - S_cost - COGS - Taxes_remitted

- Gives the seller's true take-home amount after all fees, costs, and taxes, showing actual profit and informing strategic pricing decisions.

How eBay Fee Calculator Can Help You

An eBay fee calculator turns complex fee rules into clear numbers so you price confidently, spot margin leaks, and test “what if” scenarios before you list. It saves time, reduces costly mistakes, and makes pricing decisions data-driven rather than guesswork.

The eBay fee calculator is a tool that helps you calculate the fees that you will incur when selling on eBay.

- Greater pricing accuracy: Prevents underpricing and surprise losses by applying the correct final value, insertion, and processing rules automatically.

- Measure this: percent of listings posted with target margin met (compare before vs after using the calculator).

- Faster listing workflow: Eliminate manual arithmetic and copy-paste errors so you can price more items in less time.

- Measure this: average time per listing to compute fees (track minutes saved).

- Clear visibility into true profitability: Shows net profit after marketplace fees, shipping, COGS, and taxes so you know the real margin on every SKU.

- Measure this: average net margin per SKU and percent of SKUs above your target margin.

- Smarter promotion and shipping decisions: Test promo% and shipping options with immediate results so you only boost listings that lift net profit.

- Measure this: incremental ROI on promoted listings and change in sell-through rate vs spend.

- Informed store-subscription ROI analysis: Compare non-store vs Starter/Basic/Premium plans to see when subscription fees pay back from waived insertion fees and lower FVFs.

- Measure this: months-to-payback for a Store subscription given your monthly listing volume.

- Audit-ready records and scenario tracking: Export calculations and save scenarios to justify pricing choices and analyze trends over time.

- Measure this: number of scenarios saved/month and reduction in pricing disputes or accounting reconciliation time.

What is an eBay Good Profit Margin in 2026

A good eBay profit margin is one that reliably covers fees, shipping, cost of goods, and marketing while leaving room to reinvest, typically that means aiming for a net margin in the low-to-mid teens.

Market snapshots show many eBay sellers reporting net margins roughly 10–20%, which lets you absorb platform fees and ad spend while staying profitable. (Source)

So a good profit margin on ebay would be anything above 25%.

Broader e-commerce benchmarks put average net margins near ~6–10%, with best-in-class sellers and niche brands achieving 20%+ when they control costs and pricing power. (Source)

How to Find Best-Selling Products on eBay

eBay continues to grow, which means competition will only get fiercer in the coming years.

ZIK's eBay Product Explorer gives you the ability to find the best-selling products before your competitors do. You can use it to analyze real-time data on demand, competition, and profit margins across thousands of listings.

When you need deeper insights, ZIK's Market Insights tool tracks marketplace trends, seasonality, and revenue shifts so you can confidently plan your inventory.

You can also check our 500 Best Selling Items on eBay for instant inspiration, spy on competitors with the Competitor Research Tool, or automate your workflow with features like the Bulk Scanner and AI Autopilot.

Ready to find your next best-seller? Try ZIK now and see the difference data makes.

eBay Terms You Should Know

Quick glossary of essential eBay terms you'll see every day. These short definitions help you read calculator results, avoid surprises, and price smarter—so you keep more profit, list faster, and stay in control.

| Term | Explanation (15–20 words) |

|---|---|

| Final value fee | Marketplace commission charged when an item sells; percentage of sale total plus a small fixed per-order charge. |

| Insertion fee | Fee charged when creating a listing after free allocation is used; varies by category and store subscription. |

| Per-order fee | Flat transaction fee applied once per checkout; not per item, varies by marketplace and order size. |

| Promoted Listings | Paid advertising where you pay a percentage of sale only when a promoted item actually sells, boosting visibility. |

| Managed payments | eBay payment processing that consolidates buyer payments and payouts; includes processing fees and payout timing rules. |

| Store subscription | Monthly or annual plan giving larger free listing allocations, reduced insertion fees, and sometimes lower final value fees. |

| Zero insertion fee | Monthly allotment of listings that do not incur insertion fees; quantity depends on Store level and category restrictions. |

| Buy It Now | Fixed-price listing option allowing immediate purchase at set price; bypasses auction format and sets buyer expectations. |

| Auction-style listing | Time-limited listing where buyers bid; final sale is highest bid; may have reserve or starting price set. |

| Good 'Til Cancelled | Fixed-price listing duration that renews monthly until cancelled; counts toward monthly insertion allocations and renewal fees. |

| Break-even price | Minimum sale price required to cover all fees and costs so net profit equals zero; useful planning metric. |

| Net profit | Seller's take-home after subtracting platform fees, payment costs, shipping, COGS, and taxes from the total sale. |

| COGS (Cost of Goods Sold) | Direct costs to source or produce an item; used to calculate true profit margins and pricing decisions. |

| International fee | Charge applied when shipping or selling cross-border; typically a percentage of the sale for international transactions. |

| Deposit processing fee | Fee deducted from buyer deposits on vehicle listings to cover processing; expressed as a percentage of the deposit. |

Best Product and Competitor Research Software for E-Commerce & Dropshipping Stores

The ultimate dropshipping software for eBay, Shopify, Amazon & more. Find winning products, spy on competitors, and automate your business.

N.G.C.A. Technology Enterprises LTD

1 Aprilou, 8

ARISTO CENTRE, BLOCK B,

Floor B, Office 204

8100, Paphos, Cyprus

Subscribe to Our Newsletter!

Get the best e-commerce insights: product trends, competitor insights, and latest news.