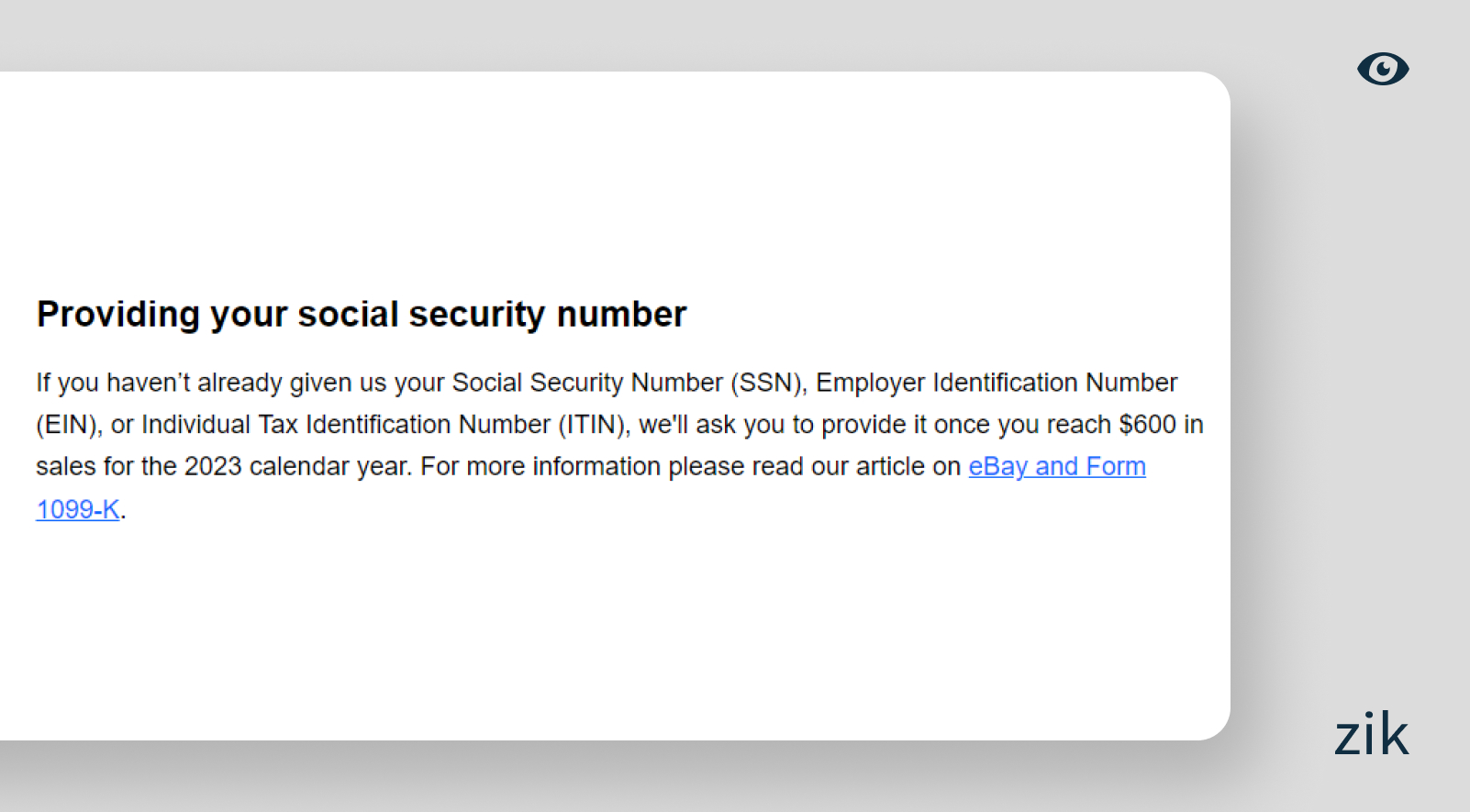

eBay sellers must provide their social security number (SSN) upon signing up on eBay. This new rule took effect in 2022, following the Internal Revenue Service (IRS) rule. This change does not apply to all eBay users or sellers who generate less than $600 in sales per calendar year. Take time to learn how it will affect your eBay account and if you must provide this confidential information in creating your eBay account.

I understand your concern about this new eBay requirement: you are wary that you are providing eBay sensitive information. It’s a legitimate concern given the prevalence of cybersecurity risks. However, it is not something eBay implements by choice or to annoy eBay sellers. It’s mandated by federal legislation!

If you’re curious if you can still sell on eBay even without providing your social security number, keep reading. You’ll find the information you need about setting up your business on eBay and what other sensitive information is required!

Article Overview:

What is a Social Security Number (SSN)?

Why Does eBay Require a Social Security Number for Selling?

Who Are Required to Provide Their Social Security Number to eBay?

Can You Sell on eBay Without SSN?

How to Tell if You Must Provide Your SSN

Steps to Adding Your SSN on eBay

What About eBay Sellers Outside the US?

Final Words

What is a Social Security Number (SSN)?

A social security number in the US is a numerical identifier for tracking taxable income and determining qualified benefits. The issuance of SSNs started in 1936; today, it is issued by the Social Security Administration.

All US citizens and permanent residents (even temporary working residents) must have a social security number. Even non-working residents must be issued one. It uses a random stream of digits and contains nine digits.

Why Does eBay Require a Social Security Number for Selling?

As mentioned, there are numerous reasons why eBay is requiring social security numbers from sellers. The new requirement came after eBay parted ways with Paypal as its payment processor. Since then, eBay has been obliged by federal legislation in the United States to require eBay account holders to submit their social security numbers and tax information. The IRS requires the information to ensure compliance with federal legislation on taxation.

Before PayPal and eBay parted ways, the former was responsible for processing payments within the ecommerce platform. If you were using PayPal to process payments, you submit your tax information to PayPal, not eBay.

However, since PayPal is no longer the payment processor on eBay since 2015, eBay implemented the Managed Payments system. This new payment system means that eBay will handle the payments internally. And since the payments are processed within the eBay platform, account holders will now provide their sensitive information, such as SSN and tax information, to the platform.

Needless to say, this new requirement and change rule on eBay is part of IRS and tax compliance measures. The IRS and federal law require eBay to report sales transactions within a particular threshold amount for tax compliance purposes.

In addition to reporting taxable transactions, the IRS imposes this rule to avoid money laundering. Therefore, eBay must report transactions over 10 thousand dollars or any potentially suspicious amount. It is part of the effort to fight money laundering activities in the US.

Who Are Required to Provide Their Social Security Number to eBay?

If you have an eBay account but use it mainly to buy goods and services, you should not worry about providing your social security number and tax information to the platform. Only sellers must submit the said information for their account to remain valid and to continue selling items on eBay.

All sellers on eBay who earn more than $6,000 in sales per calendar year must provide their tax information. Not all sellers have social security numbers. In this case, you can provide SSN or TIN. The ITIN refers to the Individual Tax Identification Number. You can use this information instead of a social security number.

If not available, you can also use the EIN or Employer Identification Number. It is recommended for any eBay seller who owns a small business. You can register online for free if you don’t have an EIN yet. You can submit the EIN instead of your personal SSN to eBay.

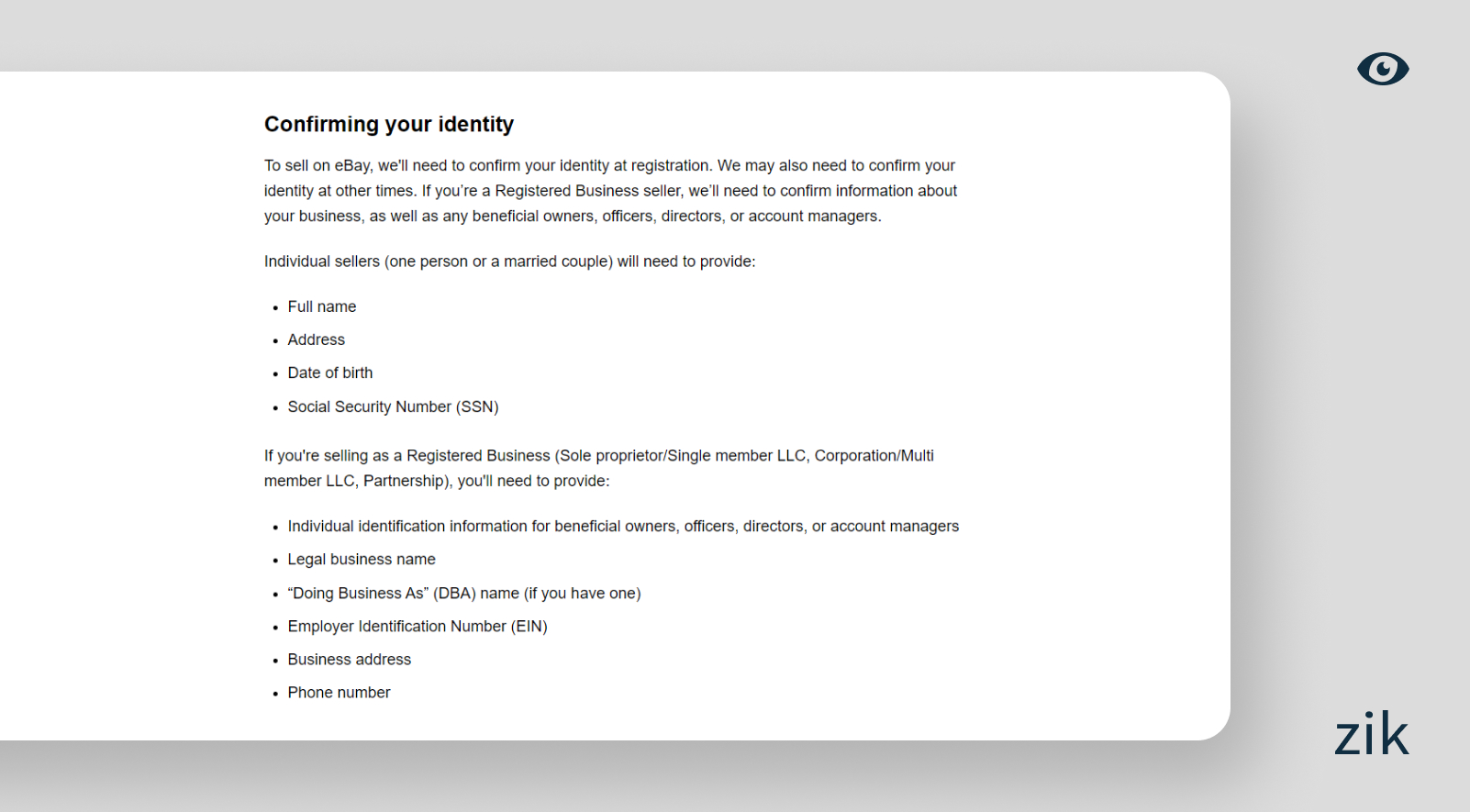

There are differing requirements when adding your tax details to your account, depending on your seller account type. For private sellers, here is the information that you must submit to your account:

- Name & Address

- Birthdate

- Social security number

- Bank account

- Photo ID

If you are a business seller on eBay, you must provide the following information:

- Business name & address

- Employer ID Number (EIN)

- Business bank account

- Beneficial owner information

Can You Sell on eBay Without SSN?

Now that you know why eBay requires sellers to provide their SSNs, you might be curious if you can still sell on eBay without one. The rule clearly states that you must provide your SSN if you earn more than $6,000 per year in product sales. If you don’t, you will not be required to provide this information when selling items on eBay.

If you have reached the minimum threshold and have not updated your tax information in your eBay account, eBay will put your payouts on hold. In other words, you cannot withdraw your hard-earned sales to your bank account until you provide the required information. You have a choice to provide your sensitive information or not, but you don’t have a choice when it comes to accessing the earnings in your account.

There is also the risk that your eBay account could get suspended if you refuse to provide your SSN even after putting your earnings on hold.

If you want to continue using eBay as a platform for online selling, you must comply with the rules and provide the information they require on your account.

For accounts that receive a notification from eBay to update their account information, you must update said information within the stated deadline. Otherwise, your payouts will be put on hold, and you cannot withdraw it to your bank account.

How to Tell if You Must Provide Your SSN

Are you not sure if your eBay seller account is qualified for requiring you to provide your SSN?

You can determine this by logging into your eBay account. You can look at your sales transactions and performance. If you have met the sales threshold, you will see an alert in your account stating that you must update your tax information and provide your social security number.

If you see this message, you must provide the required information. If you don’t, there is no need to take further action because you can continue selling items on the eBay platform without needing an SSN.

Steps to Adding Your SSN on eBay

If your account is among those that eBay requires to be updated with tax information, here are the steps to complete updating your account.

Step 1: Obtain a copy of your SSN.

You can scan your social security card with the details eBay requires for updating your account. Or you can upload other documents that contain your social security information, such as the letter that the IRS sent containing your SSN details.

If none of the above are available, you have other alternatives, such as your tax document, W2 from your employer, or 1099 form.

Step 2: Apply for a lost social security card.

If you cannot get hold of your social security card or your number from any of the above documents, you can apply for a card replacement.

Visit your nearby Social Security Office to file this request and obtain your social security number.

Step 3: Update your eBay account.

Once you have your social security information, you can go to your eBay account and update the required information. Save any changes to resume selling on eBay and lift any holds on your payouts.

You will receive an email notification from eBay informing you that you have successfully updated your account information. If you’ve supplied all the required information, you will receive notification that your payouts are available for withdrawal. It means that you can resume selling on eBay as usual.

What About eBay Sellers Outside the US?

The requirement to update tax information and provide social security information to eBay is only required for US sellers since it complies with US federal law. Therefore, sellers outside the US are not required to provide this information or the need to verify their personal information.

Sellers must know when to add (or not) their personal information, especially with the increased risk of cyber crimes. However, eBay has invested millions to boost its technical and security infrastructure to provide its eBay users with peace of mind when providing their sensitive information in using their website.

Final Words

Many eBay sellers complain about the new requirement to provide sensitive information to continue selling on this platform. However, this rule change does not apply to eBay alone. It is implemented across all ecommerce platforms, like Etsy. All sellers on any platform must provide their tax and social security numbers to ensure tax and federal compliance.

If eBay and online selling is your primary income source, you need not think twice about complying with these regulations. According to eBay, verifying your information also helps to make eBay a trusted marketplace. These steps are part of eBay’s measures to remain compliant with the IRS and avoid limiting your account’s ability to sell on eBay.