Do you pay taxes as a Shopify store owner? Paying taxes is a form of civil duty. While some online sellers on Shopify have gotten away with not paying sales tax in the past years, that is no longer the case.

No matter where you are selling, remitting sales tax to the governing bodies in your corresponding location or country is crucial. Since it is only recently that Shopify has implemented the rule to collect sales tax from sellers, there are a lot of murky details surrounding the process to pay sales tax that many sellers need to be educated about.

With my experience in online selling, I have several years of experience with sales tax returns and computing tax rates. Having clear records through the Shopify sales tracker also helps simplify reporting by showing exactly how much you’ve sold across products and time periods.

It’s understandably confusing to someone who is relatively new to the sales tax rules on Shopify. And that’s why I created this guide, among other Shopify guides on the website.

Does Shopify collect sales tax? The answer is yes. But this guide dives deeper into how to collect and remit sales tax to ensure compliance.

DISCLAIMER: We are not qualified to give you tax advice. This is simply what we have found from our research and experience. Please contact a tax specialist to check your specific circumstances as taxes vary from country to country.

Key Takeaways

- Shopify requires all merchants to collect and pay sales taxes to their corresponding physical and commerce nexus states.

- Merchants must check two things if they have tax liability: taxable products and tax threshold.

- Follow a detailed guide on how to set up your account for tax collection and filing tax returns.

What is Sales Tax?

Sales tax applies to goods and services a consumer purchases locally or online. It is collected in the US and various countries worldwide, although it might be called differently in other locations or regions.

The sales tax is the final fee that the seller collects at the final stage of the supply chain.

It should not be confused with Value Added Tax or VAT, which is collected at every stage of the supply chain. Sales tax is only collected at the final stage.

The chain of money that is paid as a sales tax is from the consumer to the vendor and the government tax-collecting agency.

But here is where it gets complicated: if you sell in the US, there are varying sales tax rules for every state or local region. Therefore, you must be informed about how much sales tax to pay the local tax authorities.

Is Your Shopify Sales Liable for Tax?

The first and simplest step is to check if online sellers like you are liable for any taxes in your local jurisdictions. If you qualify to pay taxes, you must fulfill your civil duty!

Two factors determine if you must pay taxes as ecommerce seller:

- Type of products (whether or not it’s taxable)

- Tax threshold (if you earn a certain amount from your Shopify sales)

If you meet the above two criteria, then filing taxes is a requirement by your local regulations if you want to comply with your ecommerce business. Tax registration is crucial to enable you to operate your Shopify store legally.

Once you register, diligently file taxes based on your annual sales.

As mentioned, the tax rules in the US can be complicated because you may be taxed differently if you are selling in the US and shipping your items to another state or region. I will be breaking down each step for you, so keep reading.

Setting Up Your Taxes

Setting up your taxes is the first step so you can charge all your customers with the corresponding sales tax for their purchases. Again, you can verify with local tax authorities if you’re unsure if your products are taxable or not.

Once you have determined that you must collect sales tax and remit taxes to the government, you can begin the setup process.

Go to the Shopify admin on your account, click Settings and Taxes and Duties.

Go to Manage sales tax collection and choose your specific country or region.

Choose Collect sales tax and input your tax number in the said field. If you don’t have your tax number yet, you can leave it blank and update it once you have this information.

Choose Collect tax. There is an option to add more regions and account numbers to this section, but only if it applies to you.

Once the tax region is set up, you can go to the Shopify admin to manage the tax settings in your account.

Know Your Nexus

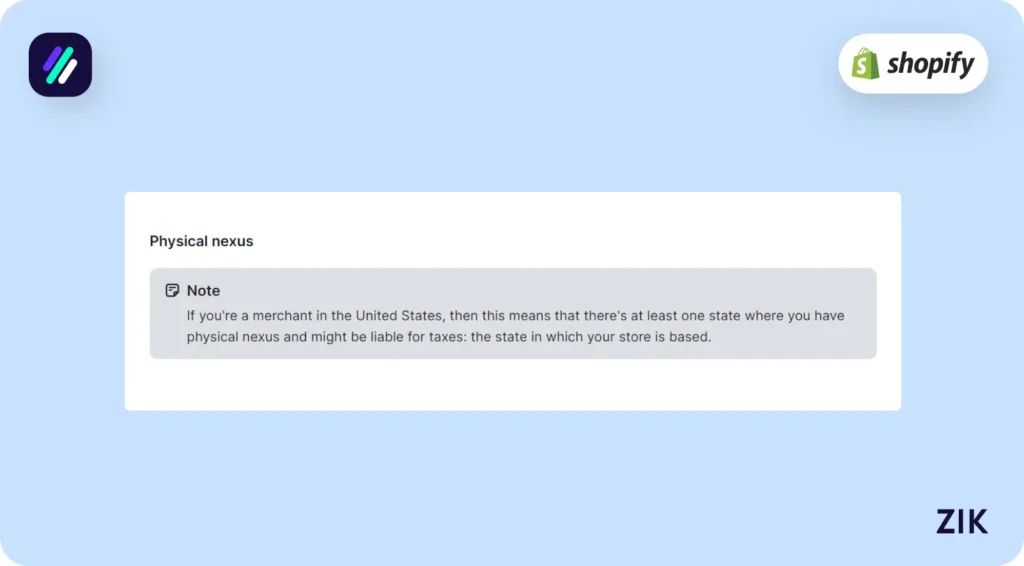

This part is another factor that complicates tax compliance in the US. Before 2018, ecommerce sellers on Shopify were only required to remit taxes if they had a physical presence in a particular state.

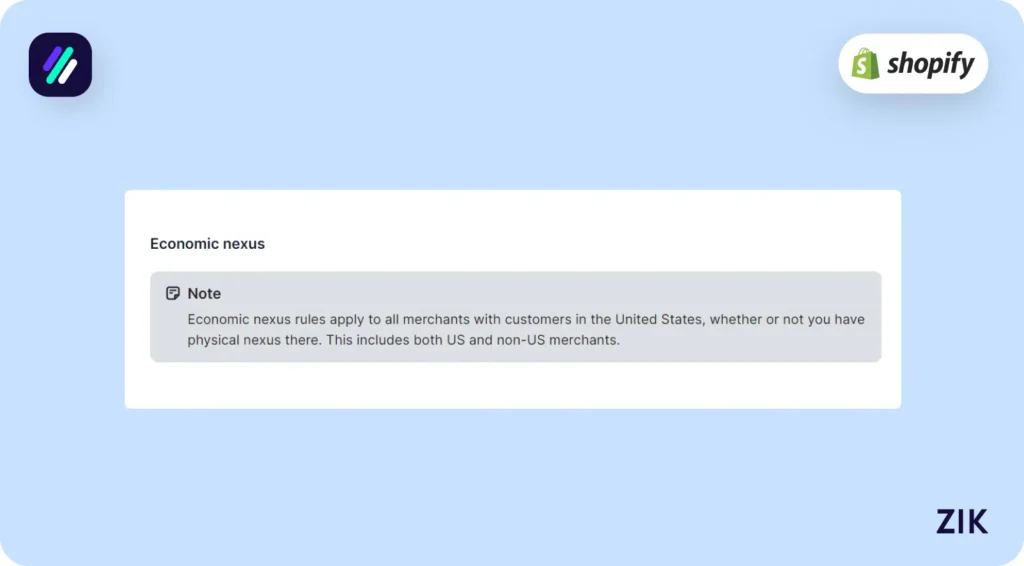

However, since the Supreme Court ruled in favour of the state in the South Dakota vs Wayfair case, it set a precedent for collecting sales tax for out-of-state Shopify sales.

Many states in the US followed suit and updated their definition of nexus to not just a physical presence but also an economic presence.

That said, the local tax authorities in a state can start collecting taxes from ecommerce sellers within the state’s physical or economic presence nexus. Therefore, all sellers with Shopify sales that qualify within the tax threshold must pay sales taxes in the applicable states with a physical or economic nexus or presence in the said state.

A physical nexus is defined as a physical business presence, such as an office, a retail store, a warehouse, a distribution center, or any space used for storing inventory. The sales tax collection applies even for a temporary business presence during trade shows or fairs.

On the other hand, an economic presence nexus is defined as conducting a business activity within the state, even without a physical store or presence.

For example, Illinois tax laws state that any Shopify sellers that make $100,000 in annual sales or have at least 200 sales transactions in their state must pay taxes to the state as they’re part of the economic presence and included within the sales tax nexus.

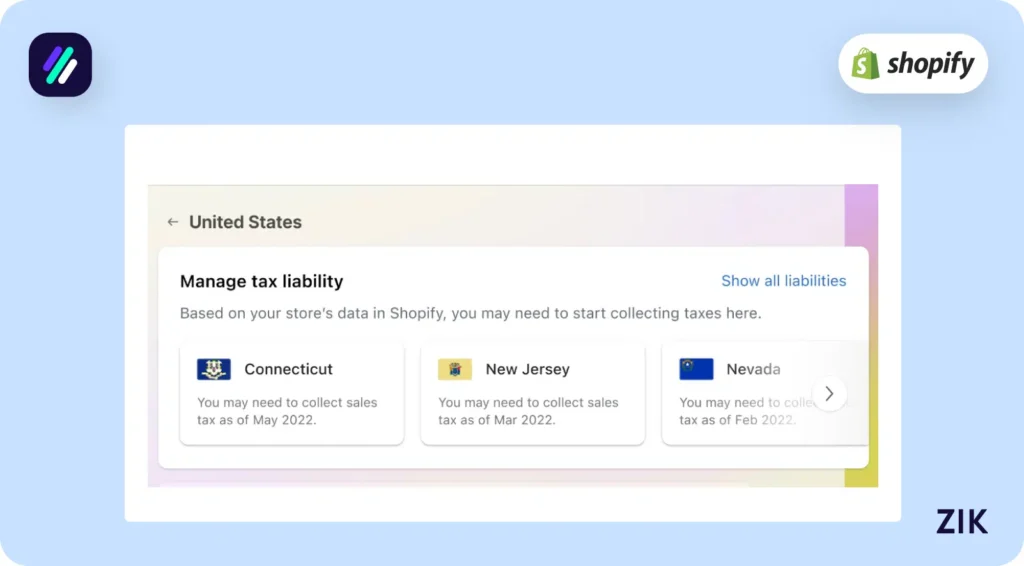

If you are unsure about your tax liability and the sales tax nexus, merchants selling in different states on Shopify can check this through their admin dashboard. You can visit Settings > Taxes and duties > United States > Manage tax liability.

You will get a notification indicating when you might have reached the sales tax nexus in a particular state/s.

Tax sourcing rules can also further confuse sellers about the tax laws. You will be remitting sales tax on the destination states or where you ship your goods and services. However, an appropriate sales tax rate could also apply to the shipment’s origin.

Checking if Your Products are Taxable

Not all consumable and purchased goods are subject to sales tax. Some products are tax exempt, so you must verify this before you file taxes to ensure that your products are not tax exempt. The policies on products that are tax-exempt could vary from state to state.

A few examples of tax exempt products are the following:

- Food/Groceries

- Services (Home renovation, legal, etc)

- Drugs (Prescription or non-prescription)

- Digital products like movies and video games

Identifying tax-exempt products, such as digital products or digital services like advertising and software-as-a-service, is the most challenging part. If unsure whether the products are taxable, contact local tax authorities or governing bodies within your jurisdiction to find the answers.

Download this eBook to jump start your dream Shopify business today!Setting Up Sales Tax Collection in Shopify Store

Once you’ve determined which state sales tax nexus you belong to, it is time to set up your account on Shopify to collect taxes easily. Go to Settings > Taxes and Duties> United States from your Shopify account.

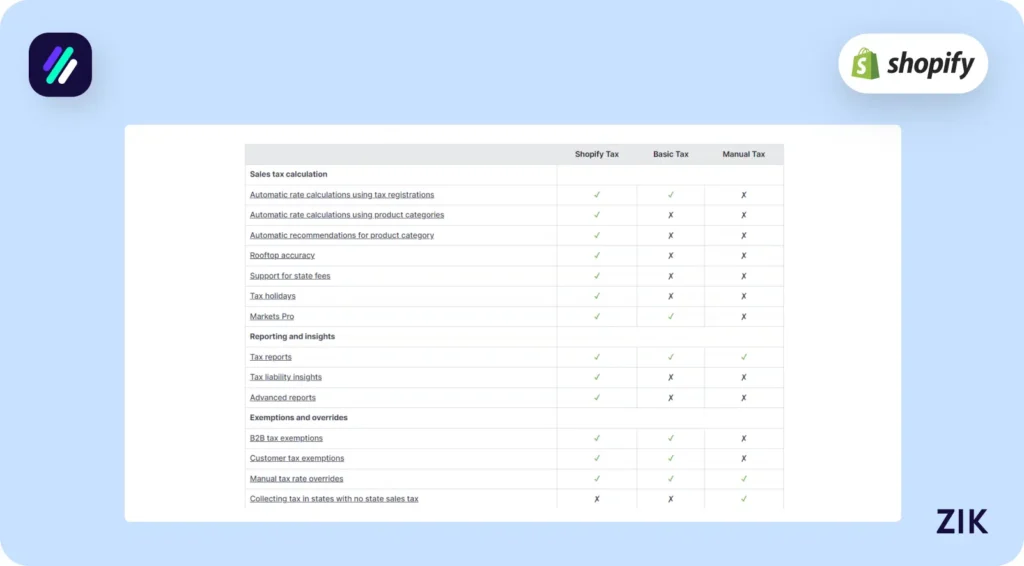

When setting up your account for sales tax collection, you must choose the tax service you’ll be using: Manual Tax, Basic Tax, or Shopify Tax.

The advantage of using Shopify Tax is that the system automatically calculates the correct tax rate for each order. The sales tax calculations for Shopify merchants are accurate to the region and product, which simplifies tax time for Shopify sellers.

On the other hand, online sellers who choose the manual or basic tax option need to complete extra steps to configure their tax settings. After you’ve completed your chosen tax service, you must set up which state you intend to collect sales tax from.

To do this, go to Collecting taxes > Collect sales tax. This action will activate sales tax collection for that particular state, and the system will automatically apply sales tax to all customers buying from that state or region.

If you are selling via multiple sales channels, you must collect sales tax for those sales tax nexus you’re a part of. Again, calculating sales tax for buyers in one state is straightforward. It gets complicated when you are collecting sales tax from several states.

Determine Tax Sourcing Rules

I’ve mentioned tax sourcing rules and will explain that in more detail here.

Shopify sellers must understand that certain products and transactions are taxed differently. It becomes confusing for Shopify merchants whether they should remit taxes to the state from where they are shipping or where they are shipping to.

Tax sourcing rules can be broken down into three.

1. Destination Sourcing

Destination sourcing refers to the taxes you must pay to the destination state or where you intend to ship your products or services. The majority of sales taxes collected are categorized as destination sourcing.

2. Origin Sourcing

This type of sales tax is collected by the state where online sellers are from. It is often the case when you create or source the products from within your state and then sell them to buyers within the same region.

3. Mixed sourcing

This tax sourcing rule applies when the destination or origin sourcing tax rules apply.

As a merchant, you must double-check which rules apply to you to ensure compliance.

Filing Sales Tax Reports

Filing sales tax reports is crucial when you have tax liability as a business.

When the tax filing date draws near, you must determine how much sales tax you owe from buyers in your business. The level of detail required from your sales tax reports varies from state to state.

Therefore, you must clearly define the sales tax nexus you are a part of to determine the sales tax report requirements.

For example, some states require you to provide the total sales tax amount you owe. Meanwhile, most states require a detailed breakdown of the transactions and the corresponding sales tax calculations.

It leads me to the next important step when filing sales tax reports: keeping your tax receipts. You should always collect and record the tax receipts to facilitate a seamless filing of sales taxes.

The tax receipt is a legal document detailing how much you charge customers for sales tax for every transaction. When the tax season ends, you can use these receipts to determine how much sales tax you should pay the local tax authorities or the government.

A tax receipt includes specific details such as the business name and address, customer name and address, tax number, a unique invoice reference number, a date when the invoice was created, a list of products or services, and the amount of sales tax collected.

On the other hand, tax receipts can be valuable if you want to obtain a tax deduction for your business. This is true of B2B customers who want to use your tax receipts to file their tax returns.

Using Shopify Tax gives you the advantage of having a new sales tax report. It will provide the essential documents you need to file taxes. While the tax report follows a specific format, you can customize it according to your needs and tax reporting purposes.

File Sales Tax Returns

Filing taxes for tax returns is where you will remit taxes you’ve collected from your customers to the state and local tax authorities. Your local government will publish the dates for filing taxes and how to file them. However, this can be done online for an easy transaction. Complete remitting taxes within the specified date, or you could incur a penalty.

What happens when you cannot collect sales tax within the applicable period?

Most states still require you to file taxes and cite them as a “zero return.” Filing the sales tax lets the government know that even though you failed to collect sales tax, you are still in business. Forgetting or failing the file sales taxes could result in a penalty.

Using Shopify Tax is advantageous when it comes to filing taxes because you will be notified by the system when the filing of taxes is due.

Conclusion: Does Shopify Collect Sales Tax?

Collecting and remitting sales tax is among the most dreaded parts of running a business for merchants selling on Shopify. However, fulfilling your tax obligations is necessary if you want to stay in business and compliant.

Luckily, you are not alone in this struggle. All businesses, big or small, must go through the process of collecting and filing sales taxes. It’s all about understanding how the process works to develop a seamless plan and get organized.

Tools like Shopify Tax allow online sellers to collect, file, and pay taxes on time.

Discover Winning Ads for Shopify Success

Want to know does Shopify collects sales tax while also boosting your sales strategy? Use Shopify AdSpy to uncover high-performing ads from top competitors. This powerful tool helps you see what’s working in your niche, find creative ad angles, and optimize your campaigns for maximum conversions. Stop guessing when you just started your Shopify store, let proven ad insights guide your Shopify marketing and elevate your store’s growth starting today.

Frequently Asked Questions on Does Shopify Collect Sales Tax

Here are some frequently asked questions on Shopify collecting sales tax:

Do I need to collect sales tax on Shopify?

Yes, if your business has tax obligations in certain states or countries, you’re responsible for collecting sales tax on Shopify orders. Shopify provides tools to configure tax rates based on customer location, but you must register where required and remit taxes to authorities.

Does Shopify Payments handle sales tax?

No, Shopify Payments only processes transactions and doesn’t handle tax collection or remittance. Shopify’s built-in tax settings let you calculate and collect sales tax at checkout, but you’re responsible for registering, filing, and remitting those taxes to the correct authorities.

Does Shopify report your sales tax?

No, Shopify does not report or remit your sales tax to the government. Instead, it provides reporting tools and tax settings to help you track collected taxes. You are responsible for registering, filing, and paying sales taxes to the proper tax authorities.

What is the Nexus threshold for Shopify?

Shopify itself doesn’t set a nexus threshold—your tax obligations depend on state laws. Most U.S. states require you to collect sales tax once you pass $100,000 in sales or 200 transactions annually in that state, which creates economic nexus and triggers tax collection duties.

Does Shopify report to IRS?

Yes, Shopify reports to the IRS through Form 1099-K if you use Shopify Payments and exceed $20,000 in gross sales and 200+ transactions annually, or meet new federal/state thresholds. Even if you don’t receive a form, you’re still required to report all income.

How much does Shopify tax cost?

Shopify charges a fee for its Shopify Tax service only after your store exceeds US $100,000 (or equivalent in your region) in global sales in a calendar year. Once past that threshold, fees are around 0.35% per taxable order in the US (or 0.25% if on the Plus plan), capped at $0.99 per order. There’s also a max annual fee cap per region (US/EU/UK) of $5,000 USD (or regional equivalent).

Does Etsy collect sales tax?

Yes, Etsy automatically collects and remits sales tax on orders shipped to U.S. states with marketplace facilitator laws. Sellers don’t need to set it up manually for those states, but are responsible for handling taxes in regions where Etsy doesn’t automatically collect.

How to include tax in price on Shopify?

To include tax in your product prices, go to Settings > Taxes and duties in your Shopify admin, then enable “All prices include tax”. Shopify will calculate the included tax based on your customer’s region, so shoppers see final prices without added tax at checkout.

How to add GST in Shopify?

To add GST in Shopify, go to Settings > Taxes and duties, choose your region (such as India or Australia), and enable GST collection. You can set the correct percentage rate, and Shopify will apply it automatically at checkout and reflect it on invoices.

Do you need a business license to sell on Shopify?

No, Shopify doesn’t require a business license to create or run a store. However, depending on your country, state, or the products you sell, local laws may require one. Always check regional regulations to stay compliant when operating your Shopify business.